Analysis Heritage Mining

EARLY EXPLORATION / DRILLING

GOLD; COPPER-GOLD; COPPER-NICKEL PLATINUM

Why I like this project

An early exploration company with 3 projects that are partially drilled (historically and by Heritage itself in 2023) and that all lie within promising areas, surrounded by prominent investors. Goal in the flagship project Drayton Black Lake, henceforth DBL) is to connect dots along a line of mineral occurences. This ‘dot-connection’ is based on the analysis of historic data, last-years drilling, plus a number of surface- and geophysical test that were also conducted last year. With a very low market caps of under CAD 5,0 mio (July 2024), a strong management team, and opportunities for early results in all three projects I see this as somewhat speculative but nevertheless attractive near-term opportunity for upside development.

I also like the broader mineral exposure, covering gold in Drayton Black Lake, copper-gold in Contact Bay and gold, copper, nickel and PGE (platinum group elements) in their recently acquired Scattergood project. Specifically the copper and gold exposure may be useful in these days, as both metals see relatively strong market interest.

Company & Project Overview:

Lets look first at Heritage’s flagship DBL project. This is located in a greenstone belt gold with the potential for so-called orogenic gold deposits. This type of deposits are among the top producing deposits in the world.

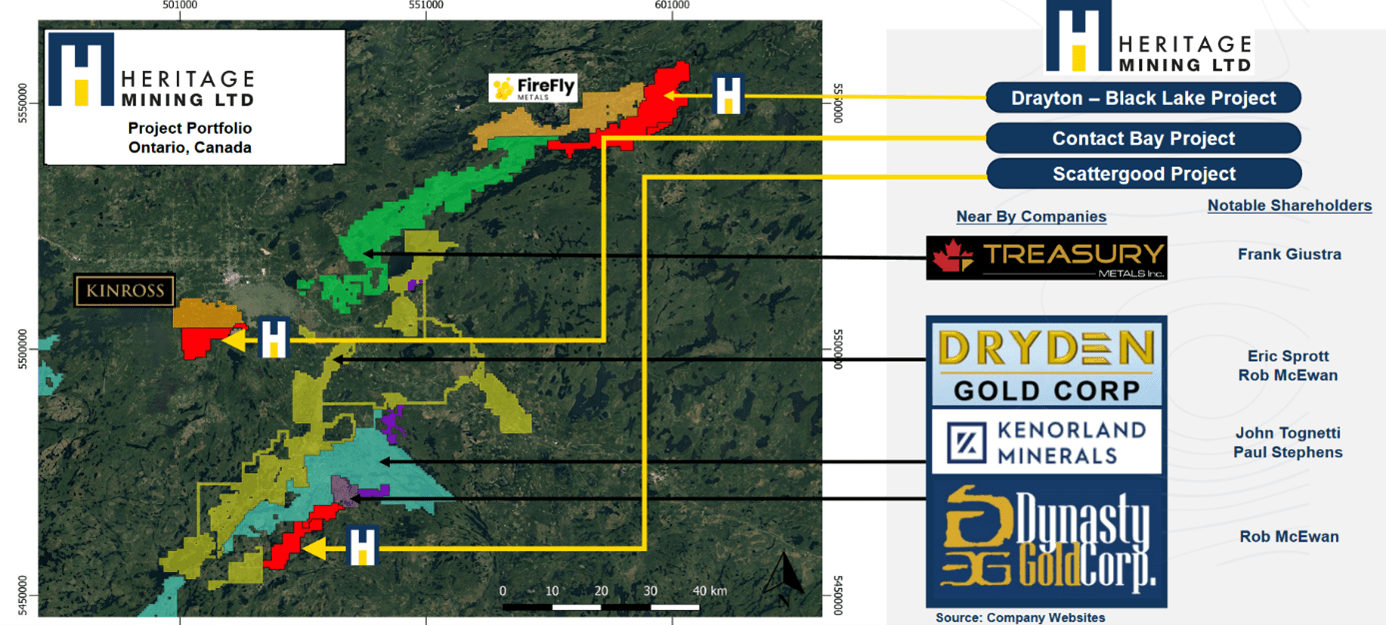

Overview of the 3 projects operated by Heritage, and some of its neighbouring projects. (c) Heritage Mining

Located in the in the Dryden-Sioux Lookout area of northwestern Ontario, the setup is somewhat reminiscent of Emperor Metal’s situation, in that we deal here with a worldclass district (the Abrams-Minnitaki Greenstone goldbelt in Ontario), with a number of Majors as well as exploration active in the immediate neighbourhood. Frank Giustra, a highly-respected Canadian top-investor invested next door with Treasury. But Rob McEwen and Eric Sprott, equally iconic investor figures in the Canadian mining scene, are there as well, with engagements in nearby Dryden and Dynasty Gold Corp. To be clear, these investments honour the location, and not Heritage directly, but as always, specifically with early exploration projects like this one, it is good to know that the gold belt it is operating in is indeed attractive.

All projects are located in a greenstone belts, and indeed an Archean greenstone belt, which host 75% of the Canadas gold resources, so we are in fertile grounds. But it is also a historic ground, and Heritage is making full use. In the area covering the various claims the company holds, there is exploration data almost covering the last 90 years, including over 176 holes drilled, even though they stem from the 1930s. However, the amount of historical data (roughly 1930s to 1980s, depending on the specific target) is quite huge. And having a lot of data can be an asset, or a burden. But in the case of Heritage, I see the team competent at delivering action here, as they analyzed a heap of data. The company way quite active with organizing, funding and delivering airborne geophysical surveys and broader field programmes for the project over the last 1,5 years. This provides me with some confidence that the upcoming, and more complex drilling programme will equally be well managed. Last year, Heritage undertook its own drill campaign. The company now has enough data to embark on a drill campaign this summer.

- Management: Peter Schloo, the CEO is as well as certified propspector as a certified accountant. Understanding the geology plus the financial aspects is a very good asset in the Junior Mining space. In practical terms, he also led a very successful marketing campaign by way of road shows in Europe and Canada. That tour alone resulted in a 50% raise of the stock price between mid-June and mid-July. Marketing by itself is nothing, but marketing plus a good project plus a good team is a lot. Heritage does have that team:

- Besides the management board, Heritage has also acquired the services of two key advisors, Dr. Brett Davis and Paul Warren, who are known for their expertise in structural geology and mining exploration. Structure is an important aspect for orogenic gold deposits, as one needs to scope those structures that hide the gold-bearing veins.

As a nice side-aspect the Company received CAD 200,000 in full from the Ontario Junior Exploration Program (OJEP) grant from the Ontario Ministry of Mines to support early exploration projects

So, what is happening at the project precisely?

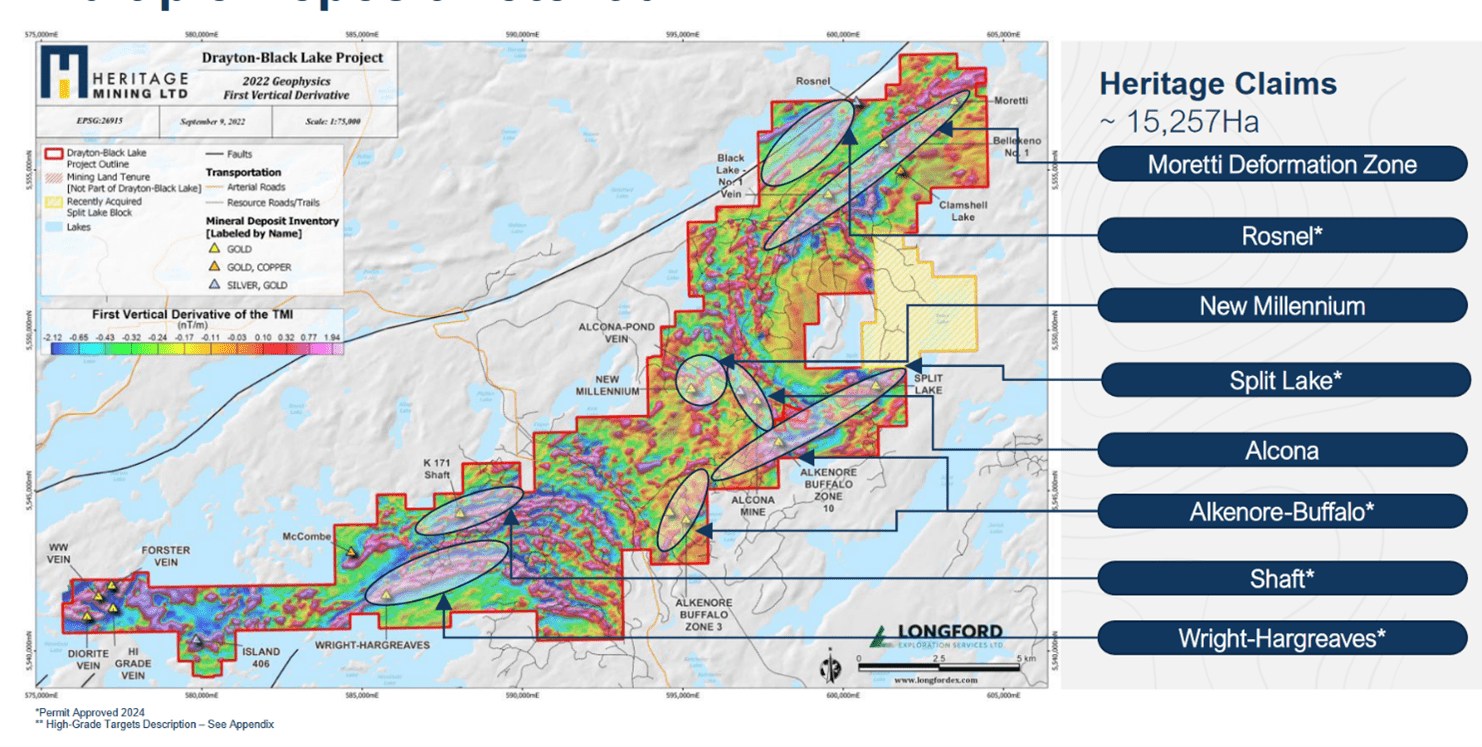

DBL is just over 15,000 Ha in size, and features gold, gold-silver as well as copper-gold mineralization. The big plus is the fact that drilling is ahead immediately, and 10 targets will be drilled in the summer-2024 programme. All targets tend to be near-surface (100m max), keeping costs down. There is sufficient budget in the coffers to undertake the drill programme this year.

Lets look at the project a bit more detailed, so that it comes out why there is potential – and where:

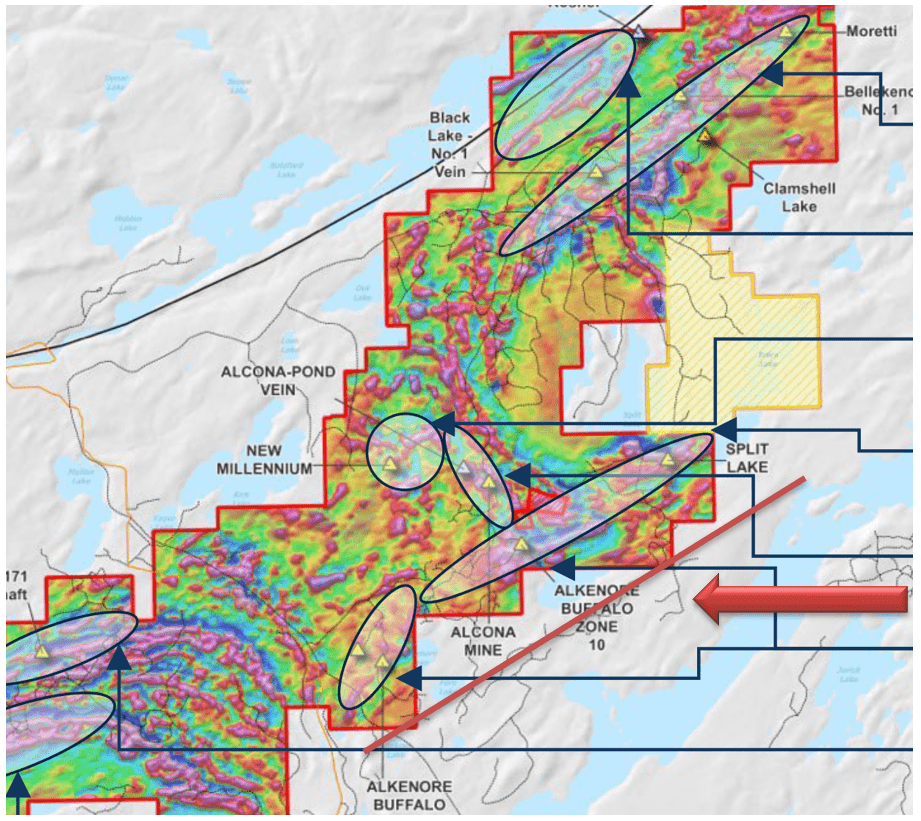

As written above, drilling is ahead, targeted at new and existing targets plus in between grass roots exploration to connect the dots. The focus will be on Zone 3. To avoid confusion, lets take a step back:

So Heritage has three properties or projects, called Dryden-Black Lake, Contact Bay and Scattergood (see picture above). But all these projects are fairly large in size, specifically DBL. Due to the long history of the project, it is also not very homogenous but features different structures – which are all different opportunities. This becomes visible below: The names on the map are ‘target areas’ (Moretti, Rosnell, New Millenium etc). Some of these target areas are further divided into target zones.

Hence we have

Drayton Black Lake (1 of three projects of Heritage) -> Alkenore Buffallo (one of eight target areas) -> and then we have Zone 3 as part of the target area.

Close-up view of the Dryden-Black Lake project, (c) Heritage Mining

Zone 3 (left end of the red line), Zone 10 and Splitlake might represent one more or less continuous gold system.

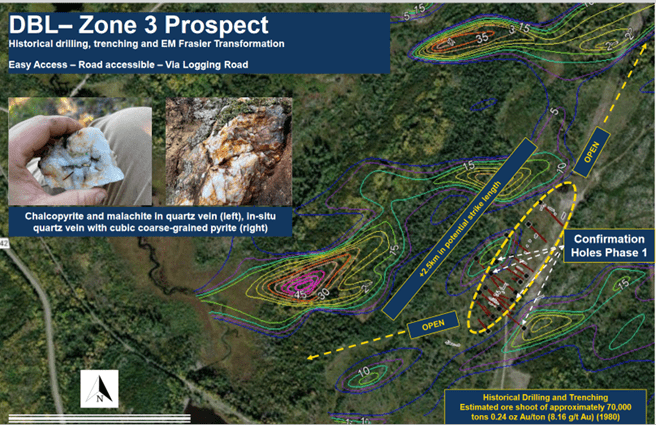

The exploration plan further includes structural interpretation and 3D geological modeling to enhance the understanding of the property's geology and mineralization. 2023 geophysical survey, grab samples and mapping all confirmed the theory of an interconnected system. That means that surface mineralization is confirmed. Lets see what the ‘truth machine’ will tell this summer. Finally, Zone 3 is also thought to host an historic ore shoot, containing 70,000mt of gold at 8,16Au/tn.

The picture below provides a more close-up glance at Zone 3:

Close-up view of Zone 3 within the DBL project area. (c) Heritage Mining

It is important to understand that even Zone 3 by itself could get very positive results of gold bearing structures if the new holes confirm and extend the historic analysis. What I am very confident of: It will promote Heritage away from a below CAD 5mio to something considerable bigger, at least twice this level. The 2024 programme is fully permitted.

In my analysis, I’d like to stay more on the brief side, as the uptake of information is limited, but I need to add a few sentences on the company’s second project, which is Contact Bay. I do so because here too we have some promising historical data, and Contact Bay is equally subject to the 2024 programme, although on a more limited basis. The property shows copper-nickel mineralization with platinum (PGE) included. Last year’s field programme has established four priority target areas which will be subject to the 2024 programme.

This will include 4 drill holes at the so-called ‘Rognon Mine Area’, as well as soil testing, geophysics and mapping for the so-called Nabish-Lake Area. At the latter, magnetic interpretation shows intrusions with multiple targets for copper and nickel along several kilometers of strike length. Here we are of course at a very early stage. But that also means that basically any results that confirms mineralization is a positive result.

Finally (this time really finally), Heritage has partially acquired (with the option of full takeover) a third property, this time again for gold (but also copper and zinc) – called Scattergood. Heritage conducts a smaller exploration program this summer here as well, including historical work compilation, geological modeling, geophysical interpretation, prospecting, soil sampling, and drilling.

Through this third project, Heritage has now really consolidated itself in this area, with more than 27,000 Ha of relatively underexplored greenstone belt under its control.

Strategic thoughts

The setting of Heritage is somewhat similar to that of Emperor Metals in the Abitibi gold belt further south. The region where Heritage is operating (when including the Uchi-Birch gold belt, which is 100km north) is among the most fertile grounds for gold in Canada. Uchi-Birch produced so far in excess of 65 mio ounces, when adding the Abrams-Minnitaki Lake Greenstone belt where Heritage is situated this increases to around 75mio ounces. Fertile grounds are also hunting grounds. This was the case for early hunters, and is the case for mining majors, specifically in the highly competitive gold industry.

Hence, projects that can show potential do have a realistic chance of being integrated by a major or at least a mid-tier miner. While this is a bit far-off for Heritage (at least no option for the next 12 months or so), partnering with a major is a more near-term solution if the 2024 campaign shows some solid results. Having a major as partner / investor is important to secure funding for more advanced drill campaigns, but will also increase visibility and uptake by the market. I see a chance for Heritage in this aspect in the nearer term.

Options for speculation and investments:

The drill is on site since a few days (early July), and drilling will start July 19th. The samples from the soil testing should be out of the labs sometime in summer. The team did some solid marketing tours throughout Europe earlier the summer, so the project will be watched – and I assume it will be bought when showing some success with its summer 2024 programme. It is also being marketed in Canada of course. Of course, there is a strong speculative note here (but which I like), so coming in early will give investors, with a little bit of luck on our side, a solid potential for stock price development.

Critical points:

While there is funding for the 2024 drill programme, the overall drilling isn’t huge (a total of ten holes in three target zones). Sure, better some drilling than no drilling, and I am in. But it sort of shifts the risk for success to this limited number. Funding and execution of further upcoming field work and drilling needs to be watched. To be fair, this drilling is not planned to get a resource estimate, but rather to confirm theories of gold-bearing structures. And they seemed to have been very carefully selected, also with the support of their structural geology specialist.