Co2-reduction with common sense

The believe one could power industrial economies with wind and sun is near magical thinking - as is the believe one could industrialize emerging economies with those sources. Implementing the former will result in deindustrialization and poverty, implementing the latter will manifest poverty in poorer countries. Adding nuclear power to the current Co2 reduction discussions provides a whole new playing field though.

PUBLISHED MARCH 24, 2024

The Atomium in Brussels is an appropriate backdrop for the March 2024 Summit in Brussels on the reemergence of nuclear power. It was constructed and built to showcase the age or progress and reason. The mastering of nuclear technology for civilian use is symptomatic for this. Now this technology and its use is experiencing its renaissance.

Ursula von der Leyen: Nuclear power a promising technology.

Thank you Ms. President. An honest thanks. Because I, and many others, somewhat thought for a longer time that the EU wants to completely disappear from the map of influential and developed economies, as the 'Net-Zero by 2050' goal was apparently to be reached by incapable energy sources.Let's hope these time are over.

Now it seems that nuclear power, which wasn’t very high on the agenda as a backbone of global energy production during most of the last 13 years, is on a powerful comeback. In large parts, this is due to its role in the climate discussion, where alternative sources of energy production which do not contribute to Co2 emission are sought.

Why renewanbles alone won't work

However – and to the surprise of some energy ‘experts’ that we had to endure over the last years, the Co2 saving technologies should also be economical. And, oh yes, available, meaning in many parts of the world (so as to limit exposure and dependence on a few suppliers). As the example of Germany shows, this isn’t true for the so-called renewables (i.e. wind and solar), which simply are too unreliable, and too expensive to be competitive without massive public subsidies. Also, once renewables take up a certain part of the mix, they need to be backed up by power generation that delivers constant electricity generation (such as coal or gas), as renewable deliver erratic supplies into the grid, which can’t be managed and needs to be equilibrated by gas/coal. That adds to the bill, making electrity from these sources, as an overall result: inefficient - erratic - overy expensive. Great. Who wants that?

It is time to reconsider. Renewables can be part of the energy mix, but as a main source they will be simply too inefficient to deliver or maintain economic growth and human progress.

These are issues that countries that seek to reduce dependence on oil and coal won’t face when nuclear energy comes up in the energy mix. Producing atomic energy is a reliable and economically viable agent of electricity generation, and it also delivers towards the Co2-reduction goals. At the moment, no other source has similar attributes.

Therefore, leaders of numerous states that back nuclear power gathered last week (on March 21) in the capital of Europe – in fact neat the iconic Atomium monument, to agree on a Declaration to set up a common set of priorities to promote this energy source.

Adding Nuclear Power

What was different in contrast to a number of ‘net-zero summits (and surely to the GOP conferences) is that this event was actually based on reason, available technology and also (most surprisingly) pro-economy and pro-people. Nuclear energy could even become the backbone of the EU power production by 2050, according to the European Commission’s prosident, Ursula von der Leyen. This is quite a surprising turn-around for the organisation, which loved to see millions of wind-turbines scattered around Europe to make it ‘Co2 neutral’ by 2050.

I see a number of reasons for this shift: First, European parliamentary elections in summer. The conservative/liberal/right-wing faction is gaining momentum, not only in individual EU member states, but most likely also on a continental level. A lot of this has to do with the fact the current ‘transformation process’ of which energy transformation (i.e. away from fossil fuels, and towards renewables) is a part, is hurting competitiveness through high energy prices. The consequences, inflation, unemployment and bleak outlooks for many European economies is pushing voters towards pro-economy parties. Hence this current initiatives might be seen as an effort to counter this tendency, and make the center parties (of which Ursula v.d. Leyen is a part) appear to be ‘pro-economy’ too. Let’s see.

Other reasons are to be seen in the difficulties of getting sufficient amounts of strategic metals like lithium, cobalt, nickel, and REE for the ‘renewables transformation’, and/or, such as for REE, increasing dependency on China.

Furthermore, the difference to lithium and REE markets is that nuclear is a tested technology, with proven capacity to generate clean and cost-efficient energy - round the clock, and independent from environmental factors like wind and sun. My personal assumption (and I am not the only one) is that nuclear will be the preferred choice of many countries next to fossil fuels. That means, in most countries the energy mix will be dominated by nuclear, oil/gas and some coal, whereby government could well push to replace coal with nuclear – and with wind and sun where it makes sense: Offshore wind farms, and sun-energy generation in very sunny areas that are near industrial, commercial or population centres. Think some areas of Arizona or Nevada for instance.

But lets look at uranium, and why it could indeed become not only the backbone of clean energy production over the next decades, but also one of the hottest metals for the next years – and as such an attractive destination for Junior Mining investors:

Scarce metals are good metals for investors:

Today, the supplies for nuclear reactors is borne by primary supplies (i.e. from mined uranium), but also from so-called ‘secondary’ sources. In metals and mining, ‘secondary’ refers to metals that have been in use before. In the case of uranium, this refers to commercial stockpiles (nuclear weapons stockpiles included – quite fascinating stuff), but also recycled plutonium, uranium from recycling (or reprocessing) used nuclear fuel, but also the re-enrichment of the uranium tails that have been used in reactors before.

Make energy - not war: Decommisioned nuclear warheads are actually a source for peacefull energy production.

But still, given the current and future need, we will most likely face a supply problem. First, the numbers: 173 additional nuclear reactors are planned to be built - and the existing 436 must be supplied too. And that could become a challenge in a few years from now: A lot of this has to do with the Fukushima accident in 2011, and the following fall in acceptance of nuclear power (independent of the fact that Fukujima wasn’t caused by a power plant failure, but quite simply by a natural catastrophy). In any case, that fall in acceptance led to lower use, lower production, and low prices of uranium. The latter have fallen to around and sometimes even below USD 25 per pound of uranium. Uranium experts give USD 60 as the lowest price to maintain mines, and USD 60-70 to allow for uranium exploration. Due to the low price level after 2011, numerous mines around the globe were put on care and maintenance, prospection work wasn’t continued and mining companies had to reduce their capacities drastically.

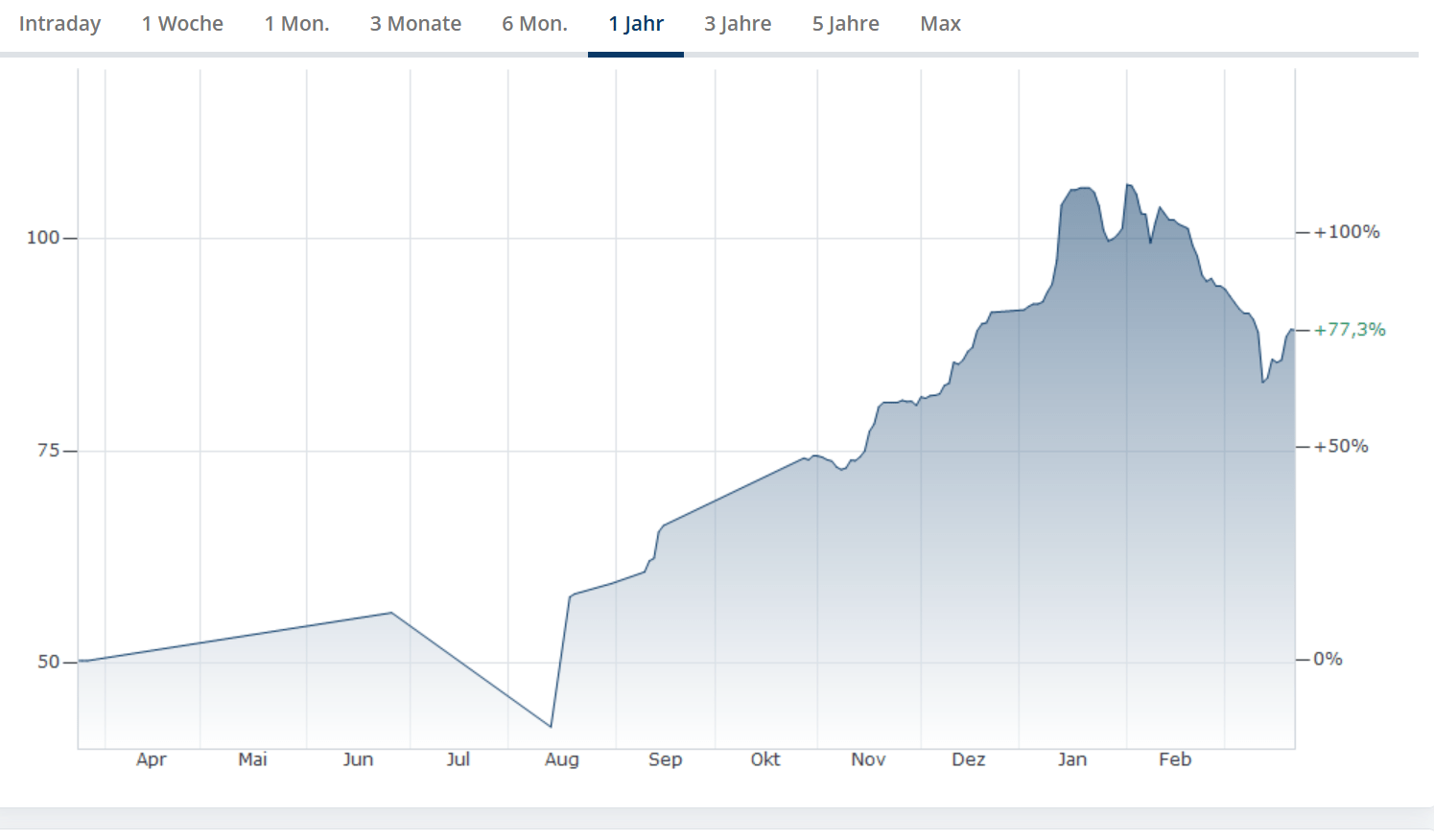

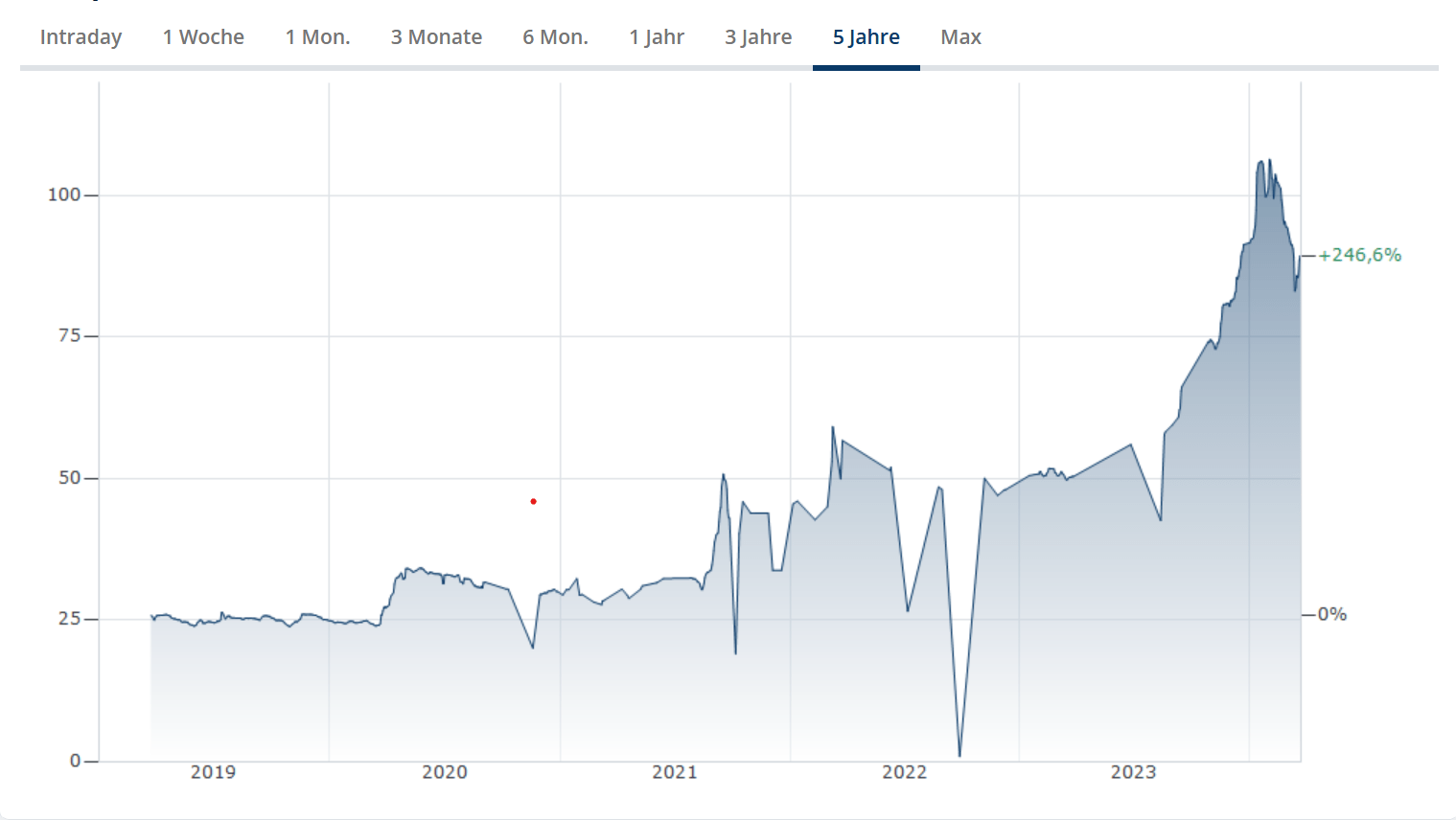

As can be seen on the two charts below, prices really became attractive again only after autumn of 2023 (left chart), while they were rather dull until that time when looking back five years (right chart):

Price of uranium October 2023 - March 2024

Price of uranium between 2019 and 2024

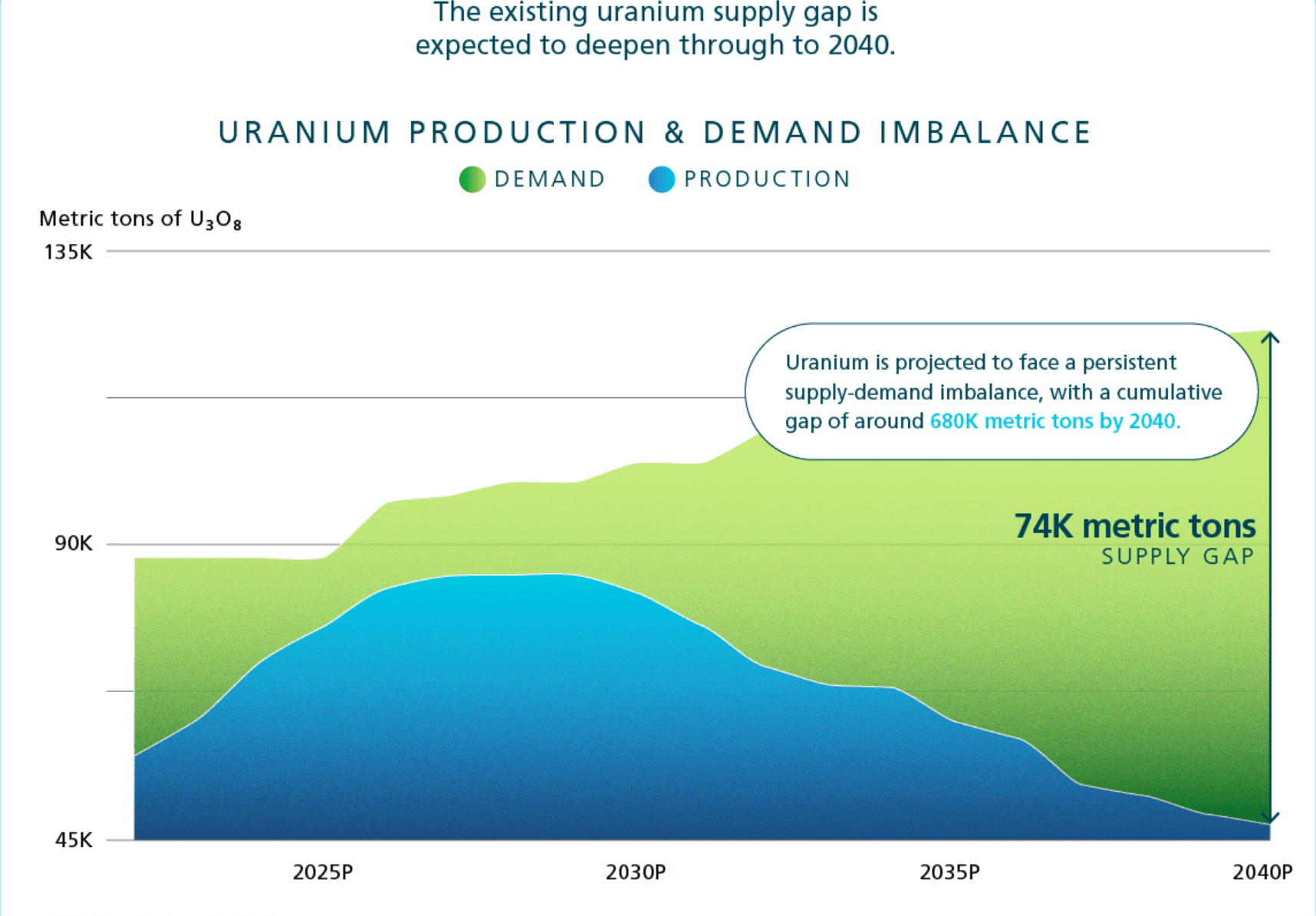

While this is going to change, all of the above are ‘super-tanker processes’ that means it takes quite a while before one actually can see changes on the ground. New mines for instance take at least 10-15 years to open up. But before that, reasonable new deposits need to be found first, and that can take another few years of concerted efforts. Also, Russia may be out, or at least its role as a global supplier will be limited for years, as is Niger. With that said, the scenario below seems rather straight:

The scenario of substantial uranium deficits towards the end of this deacde are all but unrealistic (c) Courtesy Visual Capitalist

Only a strong push for promoting exploration and Junior Miners will present skyrocketing uranium prices

Hence, the graph is very true from my point of view, and avoiding a huge supply deficit later the decade most likely will be extremely difficult and can only be softened by a solid push for uranium exploration and repective Junior Miners. Everything else would mean to jeopardize this efficient form of energy production. Australia, Canada and Namibia all have excellent mining codes that promote exploration and have the biggest uranium reserves, next to Kazakstan of course. I believe these regions will see a significant increase of uranium exploration projects in the next months and years, and it could well be that we will be finding some of the best performing Junior Mining firms in the uranium space.

Uranium reserves by country.. Graphik courtesay Visual Capitalist

In fact, when applying a bit of a longer time horizon than its normally done for Junior Miners, Canadian uranium explorer and developer NexGen Energy has been a star of the industry, having increased its stock value by more than 3000% between 2014 and 2024. Its market cap is above CDN 5 billion, and that without being an actual producer.

Check out my blog article on Junior Mining - the hidden gems of the mining industry. Why they are vital, why they are amazing - and why they can help investors reap massive fortunes

Explorado will survey this space with interest and care over the upcoming time. Propsective investors should too.

UNIQUE OPPORTUNITY TO GET INTO JUNIOR MINING

Want to learn how to become a successful Junior Mining investor in just 5 steps? Get your FREE guidebook now

https://shorturl.fm/cnvBB

https://shorturl.fm/HPnbf

https://shorturl.fm/ZgjkZ

https://shorturl.fm/A7XQE

https://shorturl.fm/zGBJd

https://shorturl.fm/a2ZoK

https://shorturl.fm/lES5k

https://shorturl.fm/vBbkx

https://shorturl.fm/DA3HU

https://vitz.ru/forums/index.php?autocom=gallery&req=si&img=4814