Analysis Ophir Metals

Earyl exploration / propsecting

Lithium

Why I like this project

Early lithium explorer with two interesting projects in the highly prolific James Bay region (Quebec, Canada). Both projects feature interesting lithium showings in rather long spodumene pegmatite outcrops. With management very knowledgeable in the region and having links with Patriot Battery Metals, I assume both properties to be made drill-ready in summer with a drill campaign following early fall.

From now to the (hopefully positive) results of the drill campaign, this is where I see the upside potential, given the current market cap of around USD 10mio.

Company & Project Overview:

Ophir Metals ran under the name of Ophir Gold until spring 2024. With the acquisition of two lithium properties in Quebec’s prolific James Bay, it has since changed its name to Ophir Metals. Fun Fact: Ophir is a mythical land of gold in Jewish mythology, similar as Eldorado in the New World, so originally, everything seemed to have focused on gold. The company still holds a gold property in Idaho, but that is not why I (and others) are viewing the company with a hawk-eye.

It is rather the two lithium properties in James Bay, a region termed by the Ministry of Mines the ‘Spodumene-Suite’. Note that spodumene is one of the most important ores for lithium. In the region, spodumene is found in so-called pegmatites, which you can think of as huge mineral veins criss-crossing through the Eastern Quebecian landscape. These pegmatites veins, which are frequently visible at the surface (so-called ) are hundreds of metres long, so make worthwhile targets for a potential lithium mine.

Lithium exploration in the area began in earnest with establishment of the Rose Lithium-Tantalum project in 2005, and has steadily intensified over the last two decades, leading to several advanced exploration and planned mines. There were nearly 400 exploration projects in the area in 2021. And also a couple of projects have developed into producing mines, or are very close to be producing mines. The graph below gives you a hint (note: Ophir’s two properties are slightly north to the James Bay property below):

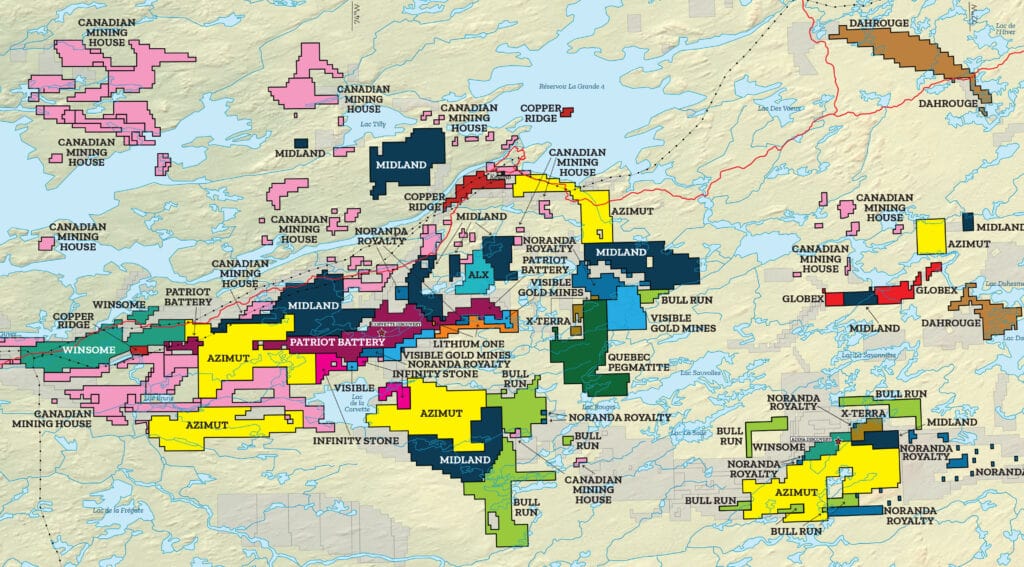

James Bay in Quebec, Canada. Highly prolific, with a number of active and upcoming mines - and one of the biggest lithium discoveries in North America -Corvette Property. Ophir has its claims in the vicinity. That is no guarantee of lithium occurence, but is a good start (c) Northern Miner

And the region is prolific, as I said. Look at the following graphs and you see what is going on. In the first graph, each colour represents an exploration company, and each coloured field a lithium exploration property:

Exploration activity en masse. (c) Market Bulll

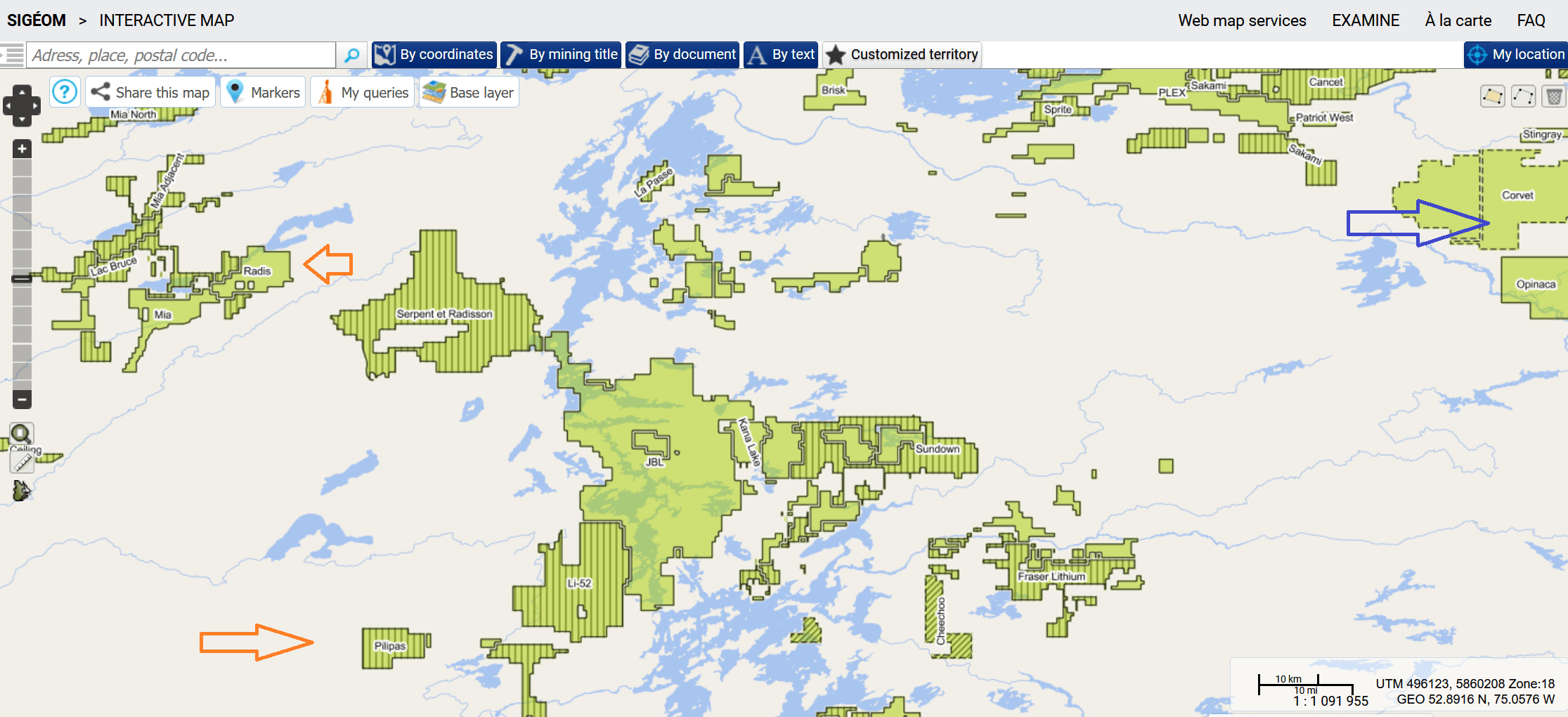

Below, you can see the two projects by Ophir Metals, called RADIS and PILIPAS (orange arrows below). The blue arrow below points to a property called Corvette.

(c) Government of Quebec

Why am I showing the two Ophir properties and their vicinity to another property? Well, Corvet, owned and developed by Patriot Battery Metals was one of the top projects in this region. In a time, the share has gained literally 1000s of percent, when Patriot discovered a giant spodumene/lithium bearing pegmatite which became the biggest in North America.

This was a company that, like many others, had a share price in the twenty-cent range most of the time in 2021. For most of 2023, it reached levels of 10, 11, and almost 12 USD. That’s what can happen to a successful exploration campaign. Note: The course has came down since then, but of course a lot has to do with investors selling of at a certain point in time.

Is that what could happen to Ophir Metals?

That is certainly what I expect. Ok, to be reasonable, not every company, not even lithium projects in James Bay will be able to repeat the story of Patriot Battery. But that is not the point. The point is that we have here a company with

- A very low market cap

- Top management; the director of geology in fact having been one of the key figures for the discovery process of the Corvet project (and still being a board member of both companies, Patriot Battery and Ophir)

- Recent success of lithium findings, specifically at its Pilipas property.

- A drill campaign ahead, which is fully permitted and funded.

That makes it a very interesting combination for me. I bought shares before the recent success at Pilipas, and have become even more optimistic.

So, what is happening at the project precisely?

Let's talk first about the Pilipas lithium property. This is the southern one in the graph above. To the north is the Radis property and to the south we find Pilipas.

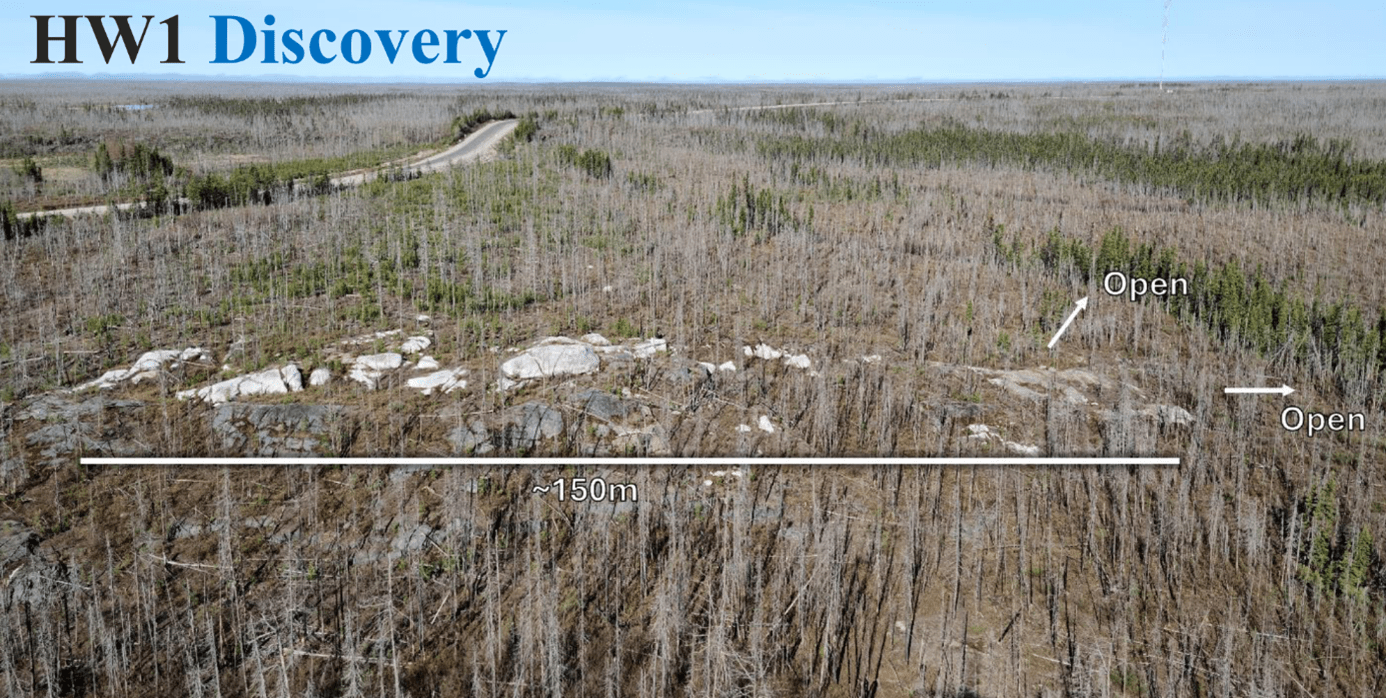

There we got good news end of June in that a system of spodumene bearing pegmatite outcrops has been discovered. Note, the outcrops are of course very visible (picture below), and someone most likely will have ‘discovered’ them before. But the spodumene inside was not. And as I wrtote above, Spodumene is one of the most important lithium ores (i.e. it is a mineral that contains lithium).

A birds eye view on one of the pegmatite outcrops at Pilipas. (c) Ophir Metals

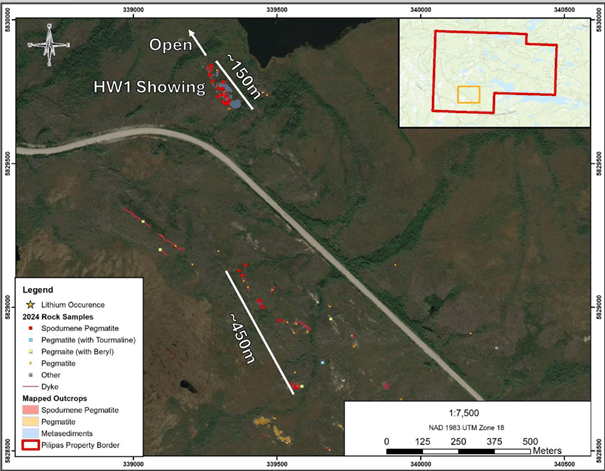

There are now at least two such pegmatite outcrops where lithium has been sampled, one is around 150 metre in length and the other one 450 metre in length and both being open, which means that the they could continue (note: they also could continue below surface).

Map of the two outcrops below:

Map whoing the two spodumene pegmatites at the Pilpias property (c) Ophir Metals

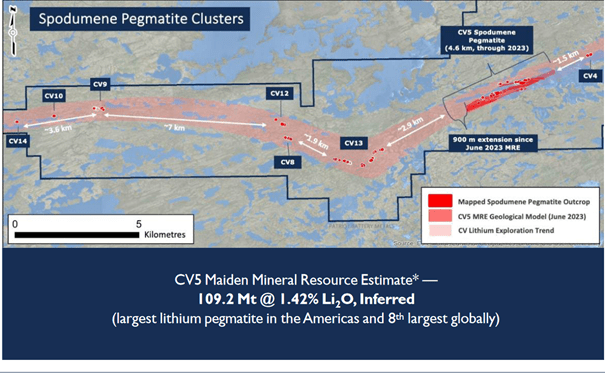

In this matter it is important to note that the pegmatites could extend for hundreds of metres and indeed for kilometres. For instance at the CV5 / Corvette property of Patriot Battery Metals that I have mentioned before, we find pegmatites that are more than 4 kilometres in length. And this CV 5 pegmatite carries almost 110 metric tonnes of lithium.

Map showing the large and extended pegmatites at the CV 5 property, Patriot Battery Metals (c) Patriot Battery Metals

In the case of Ophir this is of course too early to say but they are of course just starting.

It is important to note that Pilipa is fully permitted a drill campaign, which is also fully funded, will be conducted in in fall.

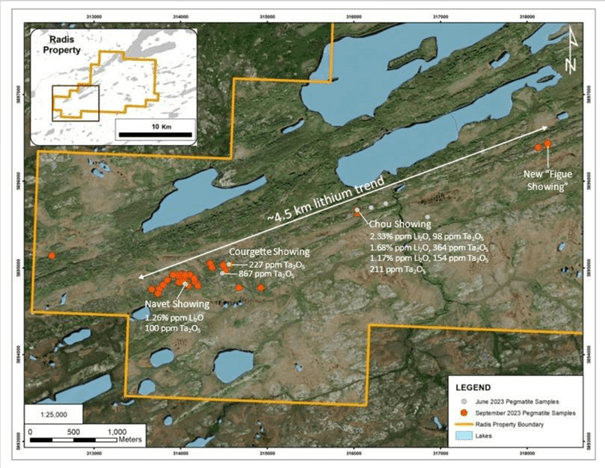

For the Radis property the situation is similar, in the sense of various pegmatite outcrops have been analysed. The interesting part here is that the four lithium showings taken together support the theory that there is a 4.5 kilometre long lithium trend present on the property.

Pegmatite trend at Radis property. (c) Ophir Metals

Will there be a continuous pegmatite along this trend? We don’t know yet, and testing, including IP testing (a test method to test for different minerals and composition, based on the throughflow of electricity) continues. Other tests have shown that most likely we may see a so-called swarm of pegmatite dykes in this area. A dyke is like a corridor for pegmatites.

At the end, it is important to note that Ophir is not yet the majority owner of either Pilipa or Radis (this is Azimuth and Eastmain / Fury Gold respectively). Such arrangements are not unusual in the exploration space. Ophir however has the option to acquire 50 or 70% ownership by executing exploration work (and cash) in a specific amount into the property.

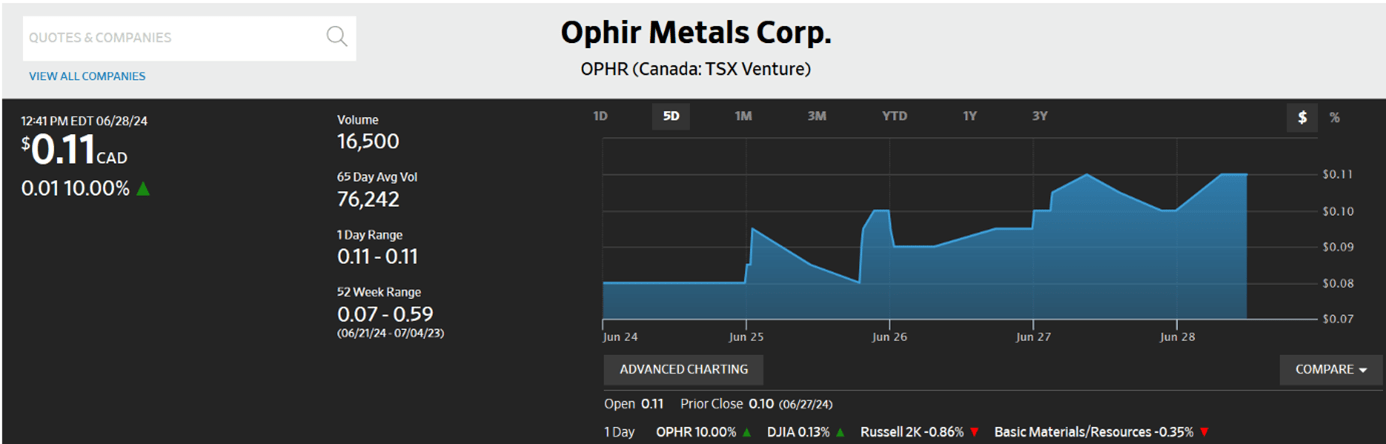

With the positive results at Pilipas the share price showed some movement over the last 2-3 weeks.

(c) Ophir Metals

Share prices of Ophir Metals reacted positively to the developments at the Pilipa property. This is good, because it shows markets are watching this project. It is, on the other side, not crazy enough to become unattractive for getting in now or even later.

Since I bought earlier (in April), it is now again at the price range I bought it for. However, I am not looking to sell anything now, but rather aim at the drill campaign in fall. We will see how the properties will be developed until then. When the drilling campaign is over, the cards will be reshuffled.

Finally, I have to say that I am fond of the very professional management team, which features a very good combination of scientific financial and project management skills. You find people in this team who have made discoveries before who have developed exploration projects and who were active in takeovers. Promotion will be important over the next weeks and months to get investors on board right ahead of the drill campaign.

Strategic thoughts

Not too complex at this stage. Maybe this is what I like at early explorers, there just isn’t too much strategy. However, by looking at the James Bay map, there is so much activity out there, that consolidation of the top projects by one two majors and maybe 2-3 mid sized players looks likely. Therefore, I am optimistic that a number of current James Bay projects will make it onto the list and become take-over candidates.

Of course, no such speculation is permitted for Pilipas and Radis at this stage. Not even for Junior Mining investors.

Options for speculation and investments:

Clearly looking at the drilling program – and at its results. Will most likely not sell until then (if nothing dramatic happens).

Further buying however could be an option over summer, depending on the price.

Critical points:

Environment; social; political risk: None Yet

Economics: Some say don’t buy if the operator is not the owner. It is ok to have this principle. However, the price to get a majority shareholder for both properties however is rather low, and at this stage, I don’t see the upside potential compromised at until the drill results are in.

Maybe something to be watched later, but no major hiccup at this stage.

Overall assessment

Interesting early prospector with two potentially fertile lithium properties in the center of the ‘Spodumene Suite’ of Quebec. With a low entry price, I look positively towards the drill campaign.