A honest review on my Junior Mining Portfolio - with an honest outlook

A few months into writing about Junior Mining investment and publishing my portfolio, including learnings and insights, it seems time for a critical review on my claims that Junior Mining investing is indeed a powerful option towards financial fortunes. Or not? I have to admit the market was beating my portfolio rather violently, but....here too, Junior Mining follows other rules as more standard markets. Find out why, despite a portfolio value loss of more than 40%, I am still very optimistic.

PUBLISHED OCTOBER 2024

Staying cool and relaxed - or freak out? This question faces us as Junior Mining investors from time to time...

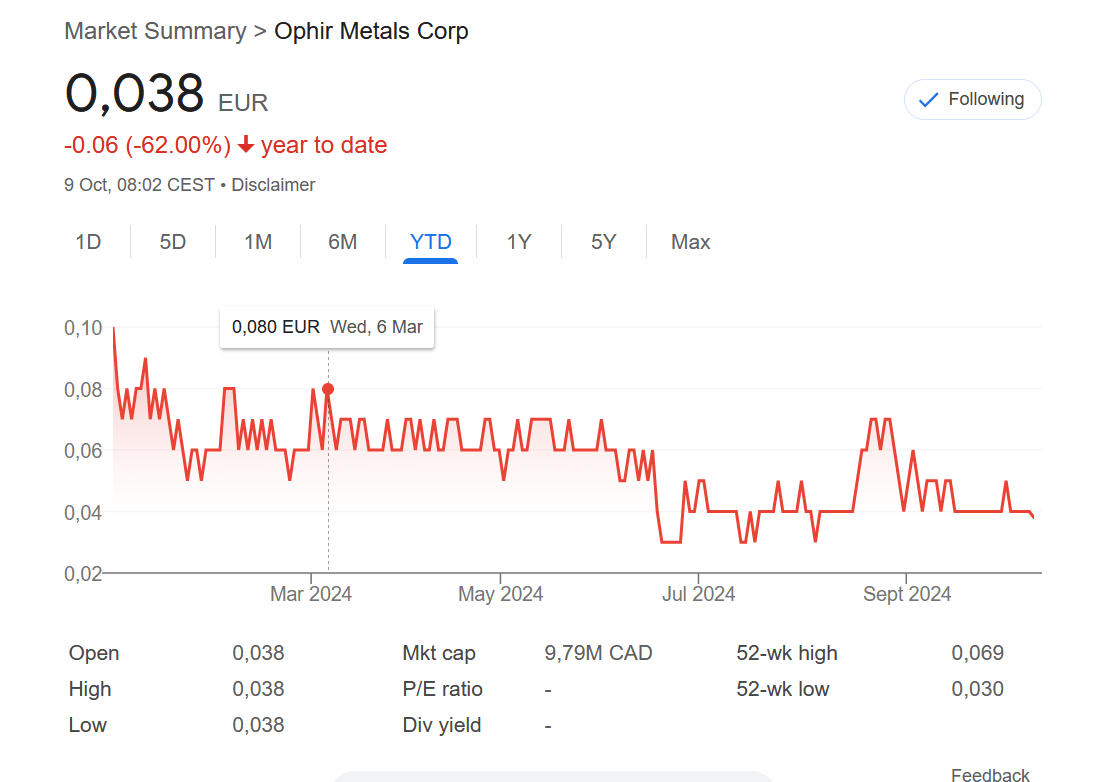

Ophir Metals:

Price bought: 0,088 USD; current price: 0,041 USD = minus 53%

Why did I buy?

- With the Radis and Philipas properties, the company boasts two sites that both feature significant spodumene outcrops. Really significant. That means potential for a discovery.

- The projects can be compared to the likes of the Abitibi Greenstone belt for gold, just for lithium. James Bay, the area where Ophir operates, has a number of highly successful lithium producers and explorers, with Patriot Battery Metals and Q2 Metals in the vicinity.

- A team that knows both lithium and the area well, and…

- …the property being ready to drill

That combination, together with the very low market cap of around USD 10mio when I bought the shares, led me to the believe it can only go upwards.

Share price development Ophir Metals, Year to Date (YTD). Time of purchase indicated

What went wrong?

At this point, what is a bit painful is the recognition that I bought literary at the highest prices level possible between the time of buying and now ☹ While I am somewhat positive when it comes to selling, the art of buying is surely something I need to improve on. In other words, while (as I outline below) I am still positive regarding the outlook of Ophir Metals, it is somewhat annoying to realize that with the same investment, I could have bought 50% more shares.

In any case, this topic might be worthwhile a seperate discussion. When you know of a promising project that is drill-ready, it is natural to buy before prices lift of. This is also what such projects did a while ago. Now, Junior Mining markets seems to much less sensitive towards such issues. Read more about this below, in my 'Comment on Junior Mining in October 2024'.

What went according to expectations?

Well, the most important thing is that drilling did take place, just as the company planned and announced. This is critical, specifically for this stage. Ophir drilled from August to mid-September, and will most likely continue again mid-October. We haven’t see results, which is the annoying part, but…

What is the outlook?

…there is no choice but to be positive. I will write this off only when bad drill results will be published, but chances are that results will be positive or very positive indeed. What is clear is that a successful drill campaign will lift projects up, specifically in that area. Nearby explorer Q2 Metals shows the way, with more than 233% growth this year, which were based on two successful drill campaigns on two properties, one of which was just acquired end of 2023 (and turned out to be a great choice):

Share price development Q2 Metals. Being a lithium explorer nearby, this company took full advantage of positive drill results. Of course I hope for a similar effect for Ophir Metals - good results of course are a prerequisite.

So, I will have to wait for a news release that tells us something about the drilling. In a way so, things are and/or could still become what was expected:

buy cheap, await drilling, ride on positive results.

The only misfit was my buying too early, and no news release out yet. I have decided to be patient here and stay (slightly) positive.

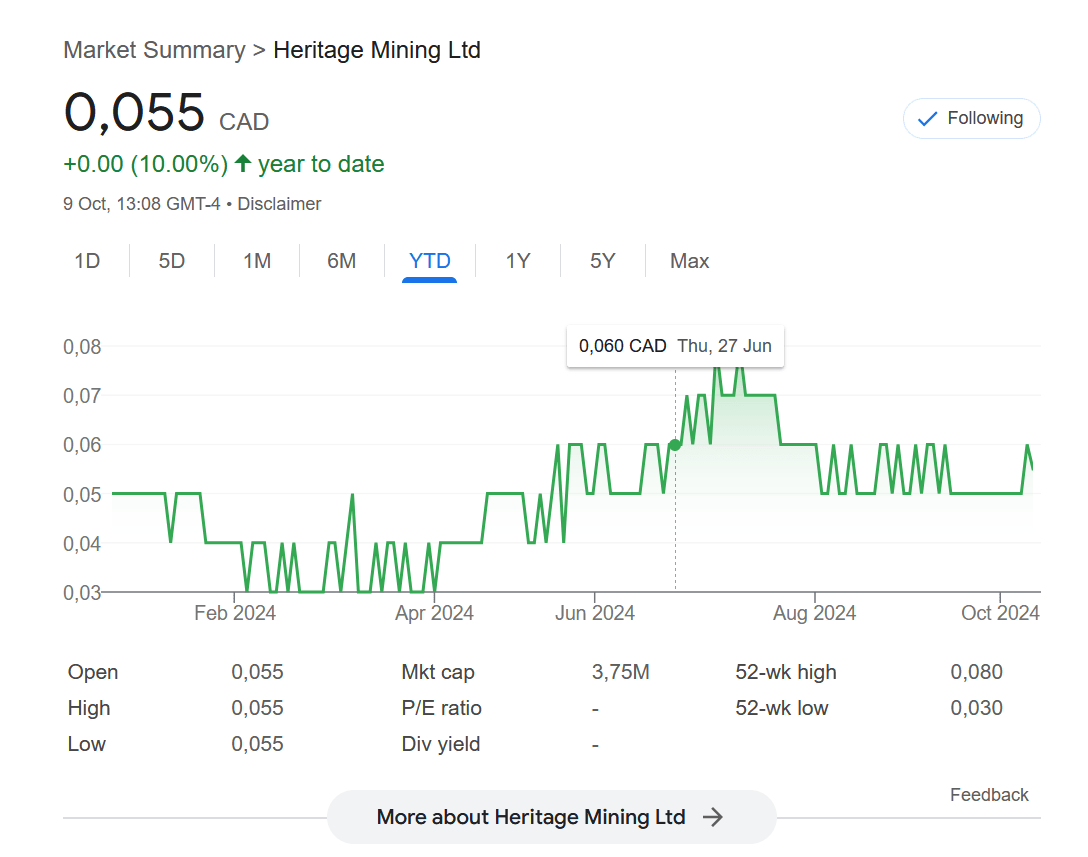

Heritage Mining:

Price bought: 0,060 CAD ; current price: 0,050 CAD = minus 8%

Why did I buy?

- Here, it was really an extremely low market cap (5mio at the time of buying), paired with 3 properties that lie in a gold-epicenter of Canada, and with historic data and previous drill results leading to sufficient confidence that there is plenty of room for an upward trend.

- Drill campaign ahead (by now ongoing)

The catalyst here as well is of course a drilling campaign which is taking place at the time of writing. As with the others, investors sit waiting for results

Share price development Heritage Mining YTD 2024

What went wrong?

Nothing really, Sherlock. The results should be out very soon. It is only 14 holes, so it shouldn’t take too long.

What is the outlook?

Here too, no reason to start whining. The management team was very active visiting investor conferences in Canada and Europe, and that is great. Making projects known is just as important as delivering results. With the first part accomplished, lets wait what the truth machine has delivered.

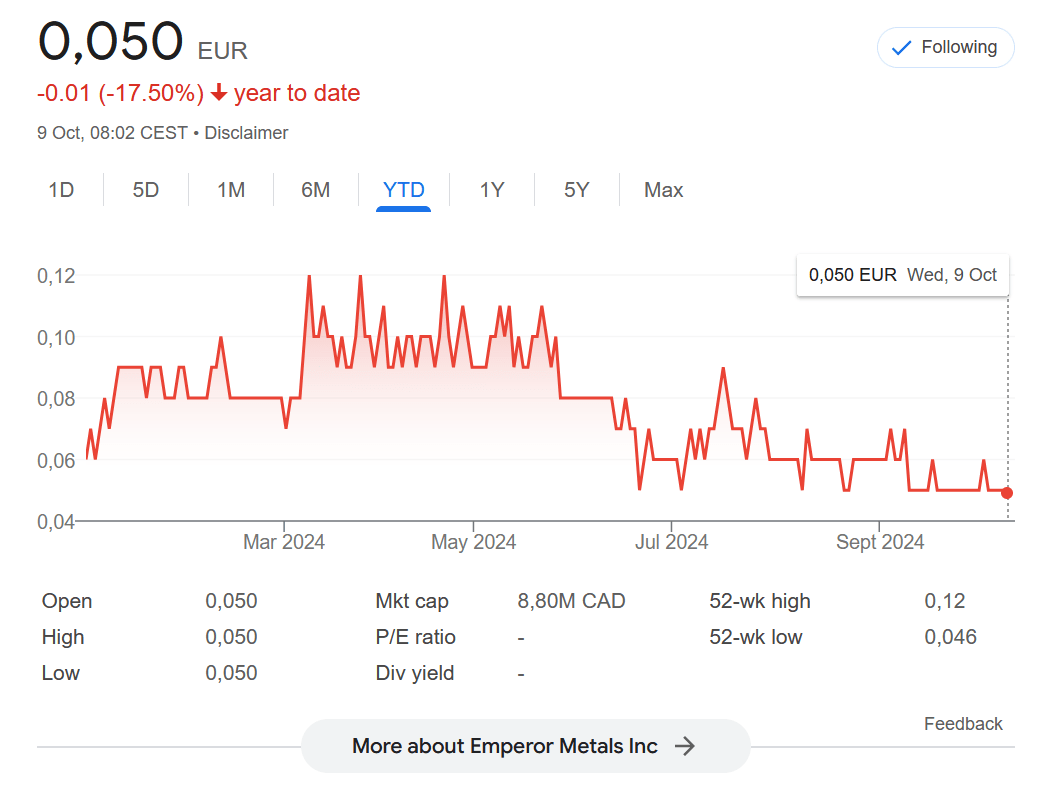

Emperor Metals:

Price bought: I bought 4 times here, at an average of 0,08 USD; current price: 0,05 USD = minus 37%

Why did I buy?

• Emperor was and still is my favourite out of these three. We do have a historic resource, 8,000m of un-assayed core, 8,000m of a new, summer drill campaign, most probably a low-grade bulk open-pit on top of a high grade underground mine, and now even a possibility for extension (the so-called Nib zone)

- Emperor is in the centre of the Abitibi gold belt, surrounded by dozenz of gold operations, infrastructure etc. If now anyone says ‘a gold mine nearby is no guarantee that there is also gold in YOUR property’, I will respond, shouting ‘Well, Emperor DOES have gold’

- All that was available for around 10mio USD.

Make no mistake, I have no regrets or doubts on this one. This is why I bought, and then bought three more times.

Share price development Emperor Metals, YTD 2024. Despite having a historic resource, the largest drill campaign of the 3 in my portfolio, and a successful step-out drill hole, it got cut down the most.

What went wrong?

The beating that the share price took is, given the quality, and given the fact that no bad news ever was produced, shockingly insane.

But it tells us more about the general mood in Junior markets (also see my comment below), than about this project

What went according to expectations?

As far as I am informed, both the drill campaign and the assay of the historic 8,000m are according to plan. So far, this company can stand tall. The market beating is not its fault.

What’s the outlook?

Strongly positive. At least according to me. A MRE of 1,5mio ounces upwards is not unrealistic, which should land the company at a market cap of at least 50mio to 70mio.

Again, patience is king. I want to be king.

A General Remark on Junior Mining Markets for October 2024:

So, for someone who likes to claim that a 100% return on investment is kind of a standard benchmark, a 40% lossof portfolio value is, well....let's not ponder. But it is not satisfying. But the truth is as well that I always state that I normally buy based on identified catalysts, rather than on price speculation which I can't afford at all. In the three cases discussed above, the catalysts are drilling campaigns, for which no result has been published yet. In other word, I can't speak of failure because of bad results. The waiting periods leading to the publication of results is a time that is extremely difficult to read upfront. For me it seems clear that in better times, when there is just more money and activity in the Juniors markets, such projects would have grown in value.

But we are not yet in these times. Not yet. For gold, most experts in the market agree that the extremely strong gold price will trickle through to the Exploration space one day. It can happen in November, it might be February. But most then also agree that once this has been accomplished, strong gold exploration projects will experience significant pushes.

Meanwhile, it is a market for the contrarian investor. If the depressed prices that I have just discussed have one advantage, it is this one: There are opportunities to buy shares of potentially great gold projects at a bargain. The current share price of Emperor for instance is not a signal to be depressed, but it is a buying opportunity.

Fortunes are made when prices are cheap, remember?

Patience is truly king in our business, and it is being tested right now. We can use the time waiting, accumulating some more share, and wait again. But all in all, I am not really worried about my portfolio.

Building a strategy based on catalysts is an important concept in Junior Mining investment - read more about that here:

I will do an update towards the end of 2024 - and I am pretty optimistic that I can show a very different picture by then.

https://shorturl.fm/kdVX8

https://shorturl.fm/pBVBT

https://shorturl.fm/Ji7B8

https://shorturl.fm/TEUEo

https://shorturl.fm/bTD6o

https://shorturl.fm/4MJDb

https://shorturl.fm/qfIKM

https://shorturl.fm/RIDf6

https://shorturl.fm/VtH5l

https://shorturl.fm/ULVjD

https://shorturl.fm/kPIbB

https://shorturl.fm/YO2bZ

https://shorturl.fm/JRNo1

https://shorturl.fm/Z70wm

https://shorturl.fm/NHgJv

https://shorturl.fm/KLm9U

https://shorturl.fm/e30S0

https://shorturl.fm/adCqf

https://shorturl.fm/gSvgv

https://shorturl.fm/8WV1c

https://shorturl.fm/ovd9e

https://shorturl.fm/FpOAt

https://shorturl.fm/aTevD

https://shorturl.fm/SqK8s

https://shorturl.fm/wmWij

https://shorturl.fm/LWJPj

https://shorturl.fm/C82tE

https://shorturl.fm/XhEi4

Join our affiliate community and maximize your profits! https://shorturl.fm/DHBlg

Monetize your audience with our high-converting offers—apply today! https://shorturl.fm/d02aR

https://shorturl.fm/retLL

Awesome https://is.gd/N1ikS2

Awesome https://lc.cx/xjXBQT

Good https://shorturl.at/2breu

https://honda-fit.ru/forums/index.php?autocom=gallery&req=si&img=7042