Whatever your investors goals - gold can help you reaching them

From the common ETF share to the mundane bullion bar, from owning parts of a goldmine to be shareholder in an enterprise that is discovering the next big and high-grade mine, gold offers plenty of opportunities, and actually for most wallet sizes. So, it is not only of eternaln non-corroding beauty, but also an extremel versatile 'investment friend'. See the following sections for the 'how to'.

PUBLISHED FEBRUARY 17, 2024

Part 2: Make Use of Golden Opportunities

Being an investor is not enough. You also need to act as one. So then, where to start comes as a natural question. Gold…isn’t that just something for Donald Trump - or Uncle Scrooge? Starting your journey into gold investments can seem daunting. It's like stepping into a glittering world of untold promise, yet with its share of risks and unknowns. But you're not alone, and it's certainly not as complicated as it may appear to be at first glance.

Starting again with category 1, you might be wondering, "how exactly do I purchase gold bars and coins?" Well, let's dive a little deeper into that. Gold bars and coins can be purchased from your local bank office, from various dealers and mints, and even online platforms, making them fairly accessible.

DEGUSSA for instance, a traditional gold refiner with operations in Germany and Switzerland, is a well-known and reliable on- and offline dealer: https://shop.degussa-goldhandel.ch/en/

Gold can be traded online through respectable platforms as well.

The most critical aspect here is to be vigilant about the credibility of the dealer to avoid counterfeit products. Gold bars generally come in weights ranging from 10 grams to 1 kilogram, which, coupled with their easy storage, makes them quite attractive for many investors. I recommend the banking route, or a respected, ideally international dealer/trader (like the DEGUSSA example, but there are more of course), or an equally respected online trader. Many banks or investment firms also offer a ‘gold-saving plans’, where you could sign up and pay a monthly pre-agreed amount of gold, until you can collect your 1kg gold bar.

You might ask, "What's the advantage?" Unlike other forms of gold investment, gold bars and coins give you the opportunity to hold, feel, and fully own a tangible asset. This comes as a psychological comfort for many, offering a sense of control and security, especially in times of economic downturns.

Also important to note is that in some countries, owning physical gold, mostly for a year, frees you from paying taxes on any potential profit you have made while holding the gold before selling it. In less complicated phrasing: If you bought 1kg of gold on January 01 2024, and you keep it at least until January 01 2025, and then sell it with a profit because the price of gold has increased, your government won’t get any of that profit. This is of course country-specific, but it could be worthwhile in any case to investigate a bit about the tax status of gold in your country.

Another thing to note is that gold is also a tender, and as such it is very liquid, unlike silver, gemstones, or houses. You can practically go into any bank or exchange office or trader and sell your bullion or gold coin (don’t take your 5kg bar with you though when visiting your local grocery store).

In terms of value, fine gold coins and fine bars (bullion) reflect the daily gold price that you can find on the internet.

Gold ETFs: Enjoy the benefits of gold – but without needing to carry it home

But let’s move on. I believe you are all smart enough to understand how to buy and sell a gold coin. Its not really that much different from buying a chocolate bar, in principle. Let's therefore now touch on Gold ETFs (Exchange Traded Funds). An ETF is a type of investment fund, an exchange-traded product, listed on stock exchanges and traded just like individual stocks.

Gold ETFs are funds that invest in gold, and their value too is therefore directly associated with the current price of gold. Hence, ETFs do combine the flexibility and liquidity of stock investments with the benefits of gold investments, making them an attractive choice for many. Managed by professionals, these funds offer a convenient way to invest in gold without the need to store physical bars or coins.

Investors can buy and sell Gold ETFs on the stock market, which adds an additional layer of convenience. Thus, they are a fantastic option if you're looking for ease of transaction, minimal storage concerns, and the assurance that your investment mimics the price of physical gold. Many find that having holdings in Gold ETFs offers a sense of financial stability. So in essence then, gold ETFs are gold bars in paper form.

One example of a well-established gold ETF is the SDPR Gold Shares.

How much physical gold or gold-backed ETFs should you have?

So, normally I wouldn’t ask such a question myself, or pose them to my readers. Because it is of course fully a matter of personal taste – and of financial prowess. As far as gold however is concerned, and as I have pointed out, it can serve at least the double purpose of hedging and wealth building.

I have also pointed out that we basically have to distinguish between the two categories of gold investment opportunities. Physical gold does actually belong into category one, i.e that which serves more the hedging function. In this regard I have suggested to use gold as a protective instrument within your total portfolio, with a rough share of 10%...or so.

Why only so little? Well, of course, your gold share can be larger than that, and I know respectable gold specialists and investors that recommend a 20% to 25% share. I will come back to this a bit later, but let’s now consider three options:

ONE - You stick to this rule and own gold in the amount of 10% to 15% of your total portfolio, using it as a hedge against crisis etc. With an upcoming major economic crisis, some shares of the rest of your portfolio may decline in value, while the gold share will increase (see part 1), potentially ensuring a stabilization of your overall wealth.

TWO - Let’s assume you are bullish about gold (as I am too, by the way), and you decide to have the majority (let’s say75%) of your total portfolio in physical gold. After all, mid- and long-term outlooks are good, no? I also said so in part 1. But…, there are clear indications that investing in the stock-market over lets say 10 or more years clearly outperforms gold. Investing in a broad set of shares that cover various sectors and geographic regions will most likely lead to larger wealth than just owning gold, or even keeping gold as a major share. I have pointed out the hedging function as well as the stability in wealth – which is true. But smart investors want their portfolio to actually grow, not just stay even. Hence, in view of total wealth accumulation, I personally do not own much more than 10%, and I’d rather invest in other areas as well to take full opportunity of the various economic ups.

Note however that this suggestion is based on PHYSICAL GOLD ONLY. As I will explain further below, there are other forms of gold exposure that could yield substantially higher growth rates than just the gold price.

THREE - You might of course also consider, beyond the 10% basic hedging, a regular gold saving plan. Because after all, lets say you would buy 1 ounce of gold every month, you would earn 12 ounces of gold after each year, which at current prices, would yield roughly USD 24,000 – of stable wealth, as explained. Over the years, you could show up with a respectable portfolio. Is that not a compromise?

Well, I think so – somewhat. You could, and indeed should increase your exposure to physical gold, because if your total portfolio growth in value, so should your gold share. Remember, this 10% share is not a bad idea after all. So you can have a gold saving plan installed that reflects this fact. Or, alternatively, you buy 10% of your annual overall portfolio wealth each year in physical gold.

In the end, as a economic liberal, I also don’t want to be too restrictive in my suggestions. People have different preferences, and having more or less of the proposed amount of physical gold will also be ok. Just consider however also other opportunities to grow your total stock of asset, as this is the most important result after all.

Profit from gold price increases with lower capital requirements

Gold futures too are directly linked to category 1, but they have the added advantage that you can take benefit of a price increase, without needing to pay let’s say USD 2,000 to get a meagre ounce of gold. You need to trade via a trading account, and different brokers offer different instruments of futures and options, but you will most likely be able to start trading with USD 100, or sometimes even less,

In principle, gold futures are, as the name suggests, a contract in which a buyer agrees to purchase, from a seller, a specific quantity of gold at a predetermined price on a previously agreed delivery date. Options work similar (note that there are put options = option to sell, and call options = options to buy), with the difference between the two being that with a future the participants HAVE TO do the trade, while with the option, there is, well…the option to do so.

Shares of physical gold, ETFs, or futures / options in your total portfolio - final thoughts

Gold loves quantitative easening. The more fiat money floods the markets, the higher the tendency for gold's appreciation.

There is one more mechanism I would like to mention, and that could justify to briefly increase your share of gold (under category 1) in your portfolio. While we talked a lot about 'economic crises' and the usefulness of gold to hedge against those, the problem of course is that it is hard to take added advantage of those crises due to their inherent unpredictability.

However, gold also reacts to loose monetary policy, or quantitative easening, if you want to use a more professionally looking term. More money in the markets means lower interest rates, and, depending on other circumstances, a drift towards inflation. Such acts normally also support increasing gold prices, and, as an added benefit, such acts are normally better to predict. Hence, if you want indeed to have some short- to mid-term increase in value of your gold portfolio, you could surely increase your gold share when your analysis tells you that a longer term of quantitaive easening is looming ahead. A number of gold insiders see such a period coming again for 2024, with a corresponding gold price of anything between USD 2,100 and up to USD 2,300 per ounce.

Now, let us talk about gold investment options that fall under category 2:Investing in gold miners

We are now leaving category 1 gold investments and are heading to category 2. As pointed out in the first part, these are investment vehicles that are still 100% or at least majority gold focused, but with a less than 100% attachment to the gold price. Hence, their ups and downs follows other mechanisms than just this price, yielding potentially higher gains (and losses, of course).

Buying shares from gold mining companies is one of the best known of these options (for an overview about miners as investment destination, also see my seperate blog article here)

What options do investors have to invest successfully into the industry that is at the base of everything?

As it is obvious, these are the companies that mine for and sell pre-refined gold.The table below provides you with an overview about the biggest gold miners by gold production. What is interesting is that there is quite a consolidation taking place at the top, with Newmont being a true juggernaut, latest since 2019 when it swallowed Goldcorp to become the world's biggest gold miner. The top 3 have a market capitalization that equals the total of positions 4 to 8, and the top two production really dwarfs their competitors.

Company | Gold production (in mt) | Market cap |

|---|---|---|

Newmont | 185,3 | 38,53B USD |

Barrick | 128,8 | 25,64B USD |

Agnico Eagle | 97,5 | 23,75B USD |

Anglo Gold Ashanti | 85,3 | 7,27B USD |

Polyus | 79,0 | 16,58B USD |

Gold Fields | 74,6 | 12,27B USD |

Kinross | 68,4 | 6,23B USD |

Newcrest | 67,3 | 13,69B USD |

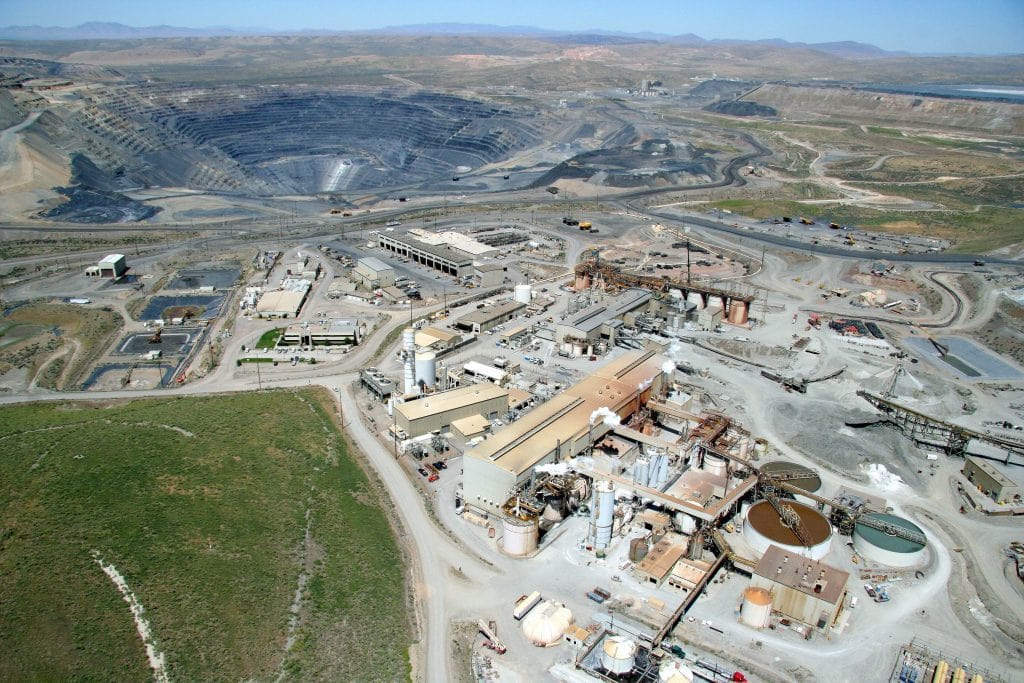

The Nevada Goldmine Complex is the most productive accumulation of gold producing deposits of on the globe. Consequentially, it is owned by a JV of the two biggest gold producers, Newmont and Barrick.

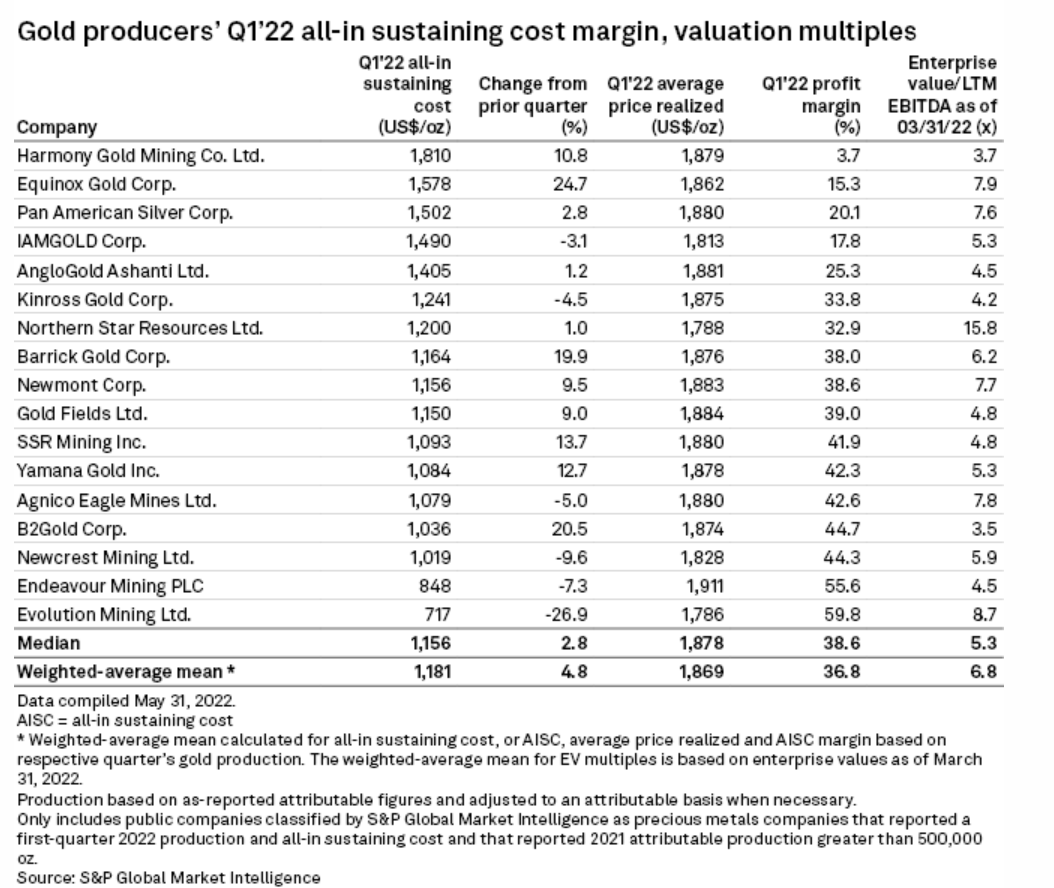

While your returns on investment (ROI) somewhat depend on the gold price, what is more important is the profitability of the gold producer, or in other words, how much profit it can make from each ounce it mines and sells. Hence, another category comes into play here, and this is the cost side. A gold miner will be more profitable the lower its costs – as the income side is given due to the gold price.

There are geological, technical and socio-economic factors that play into the cost side of companies: There are some mines which are just cheaper to mine than others (because the gold might sit closer to the surface, it might be easier to separate from the host-rock and cheaper to refine it etc.), and some countries have lower wages than others. Exchange rates and taxation also come int play here. While this all falls under OPERATIONAL EXPENSES (OPEX), companies also need to buy machinery, write of debt-repayment etc. These make up the capital expenses (CAPEX).

But there is more to it: In 2013, the World Gold Council suggested to use the concept of All-In-Sustained Costs (AISC), which looks at the total expense over the whole lifetime of the mine, and also including exploration costs, administrative costs etc.

For many (but not all) miners, you will find the AISC figure in their main presentation or in their financial reports. The bigger the difference between AISC and the gold price, the bigger the profit of the miner.

AISC in ranking. While other factors should also be part of the consideration to invest or not invest, the relationship between AISC and profitability is somewhat evident (c) Standard & Poor

Here too, gold funds that invest in miners ca take away some due-diligence requirements from you, as professional fund managers take care of these things.

Mix and Match: Diversifying Your Gold Holdings

As I wrote above, gold is probably the commodity that allows you the most variety in terms of investment vehicles to choose from. But in order to make full benefit from this variety, you need to understand your investment goals, risk tolerance, and liquidity needs at specific times before you choose the best form to invest in.

You may hence consider a mixture of different options. After all, diversification is often the key to a successful investment portfolio. So, if you are a true gold bug (i.e. you believe in the mid- and long-term growth outlook of gold – and you should), you may take the hedging option with physical gold and/or ETFs, or also the futures/options route. Additionally, you can buy gold miners shares, or buy shares of funds that invest in a number of gold miners. Often, funds will also have shares of other precious metal miners, and sometimes also buy into bullion.

One element I would like to discuss at the end is again the potential for turbo profits. And in this case, these are fairly independent from the gold price.

Junior Gold Mining: An Untapped Investment

I was of course talking about Junior Miners at other occasions (here, and here). If you have read my blog article on Junior Miners in general, the following section might not be news to you. There are however two facts which are worthwhile to point out as far as Juniors in the gold space are concerned.

Wildcat's drilling operation at their Tabba Tabba project in Northwestern Australia. Drilling constitutes an important step in the life of a Junior Miner, and positive drill results will pave the way for a successful project development campaign (c) mining.com.au

The first is that their rate is only very loosely attached to the gold price. And the second fact has to do with the ‘peak gold’ theory I was explaining in the first part of the Gold Investment Blog.

So, what do I mean? In the peak gold section, I was providing two graphs that clearly demonstrated that both the number of discoveries as well as the gold grade contained therein is steadily declining. Now, add to this fact the reality that on average, we have around ten to twenty years of a time gap between a discovery of gold, and this discovery actually producing gold.

That means even if you discover a deposit today, this gold will be on the market in ten years, if all works very well (and it rarely does). Given what we showed in the peak gold graphs, this trend of decline will most likely have aggravated by then – big time. The gold that you discover today will be sent into a market that is starving for gold!

And this has consequences for the Junior Mining market even today. An explorer that can show it is sitting on a promising property (note, I didn’t say ‘on a discovery’) is highly likely to receive funding and with even remote signs of progress, will also experience share price increases.

Learn for FREE how you can successfully invest in Junior Mining - in just 5 steps!

Unique opportunity to boost your gold investment revenues x10

‘Sitting on a promising property’ hence could well be enough to send share prices upward. And again, for this not even is a successful drilling campaign required. Being in the vicinity of high-grade producing mines, or of other successful exploration projects is a good start. Add to this some first successes in lets say surface sampling or other positive tests would underline….well, in essence it would underline the hope that the market puts into each new gold project. A hope that this project will be at least an average hit and relief the stress out of the gold market.

That in turn would happen even if gold prices are not doing particularly great during the particular month when this Junior is performing its work. This is why I said that the success (i.e. potential share price increases) of Junior Miners in the gold space is somewhat delinked from the actual gold price.

As I wrote in this first part of the gold blog, the mid- and long-term outlook of gold is very positive, and therefore markets will show gratitude towards any Junior that could have the potential to supply the gold market in some distant future.

However, if you didn’t read my blog on Junior Miners yet, here a few condensed words of guidance (and wisdom):

What are Junior Miners doing?

Junior Mining or exploration are companies that look for new deposits, in our case here of gold. While the large mining corporations also do some exploration, they mostly keep it in the vicinity of their existing mines. As a consequence, the majority of new deposits gets discovered by Juniors.

In other words, if you are following a decent Junior Miner in the gold space, keep on following even if gold falls from around USD 2,000 to USD 1900 and maybe even USD 1,800. Try to understand why the decrease takes place, but again, as long as gold keeps its position it has now, it shouldn’t make a good gold exploration project unattractive.

Understanding Junior Gold Mining Investments

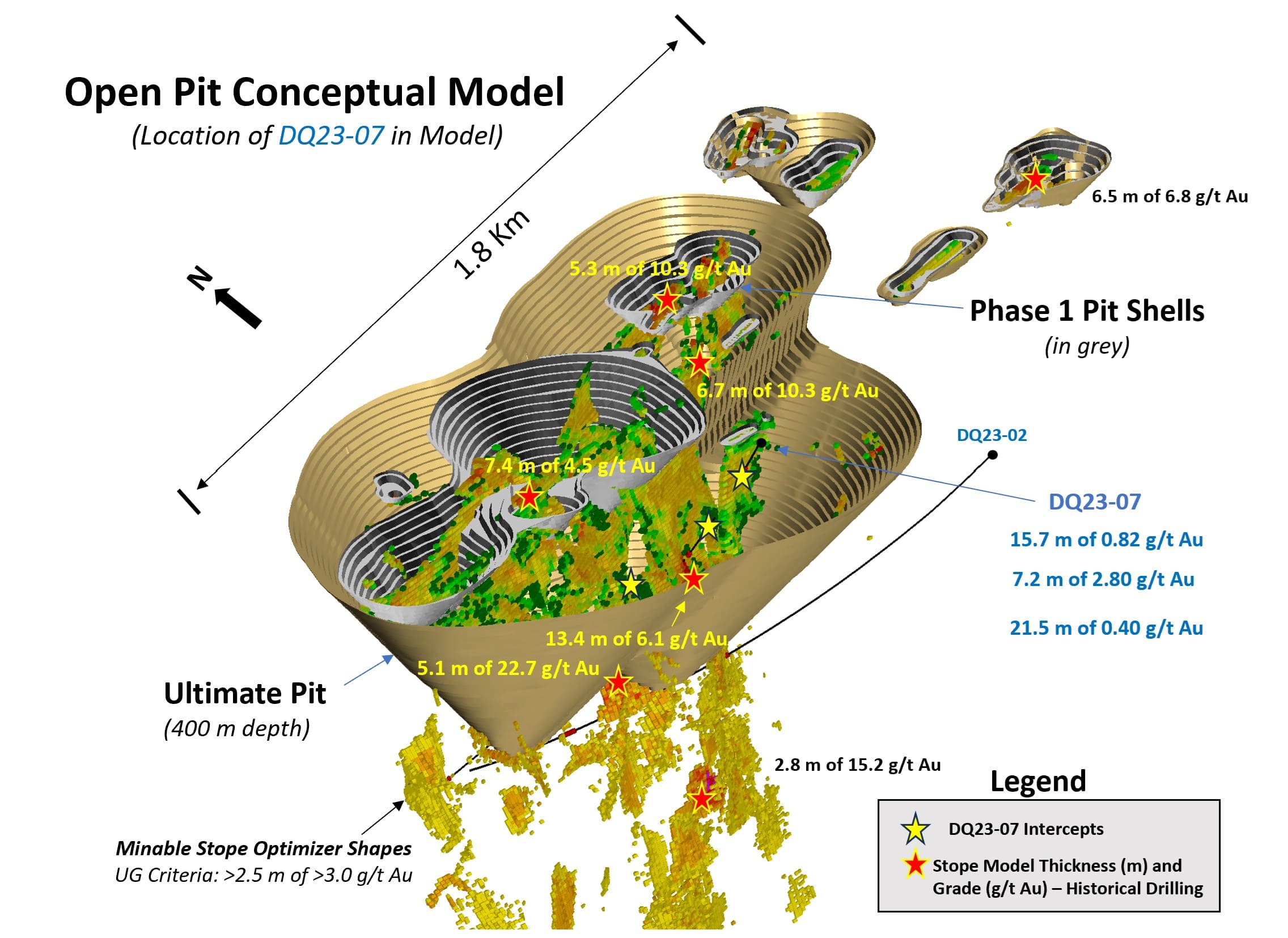

Investing in Junior Gold Mining companies can be quite rewarding. As I explain elsewhere, the beauty of putting money in there is that a company can grow from a few-million dollar corporation to a firm that sits on a gold deposit worth 500 million or more.The picture of a 3D model of a potential gold mine below is exemplary: This is from a Junior Mnier calles 'Emperor Metals', which is developing a project in Quebec, with an historic (i.e. previously researched) resource estimate of 727,000 ounces of gold. It has currently a market capitalization of roughly 11 mio USD. You can do the math. DISCLAIMER: THIS IS NOT AN INVESTMENT ADVICE.

And while that mentioned project still faces a lot of challenges, successfull procedures can have enormous impacts on share prices. And, what is more important, and CONTRARY TO PUBLIC BELIEVE, a junior miner doesn’t need to find and develop a deposit that needs to end up in a new mine. Making PROGRESS ALONG THIS ROUTE offers plentiful opportunities to Junior Miner investors to cash in. Often, investors sell (with a profit) and leave their companies after a few months or 2, 3 years, and never look back if this company will actually build a mine – they have earned enough money even before.

3D Model of Emperor's Duquesne West Gold project, located in Rouyn-Noranda, Québec, Canada. The project hosts a 727,000 oz Au historical resource.

The key to successful investment is thorough research and understanding these risks. This includes understanding the company's management structure, their strategy, but also what is the gold project about? Are they looking in an area where there are existing or past-producing mines nearby? Are there other exploration projects nearby, and how are they doing? These are normally the first steps to get an idea of what’s going on, and to keep risk manageable.In the example of Emperor Metals above, we have a historic mineral resource estimate, with countless exploration projects and indeed producing mines in the vicinity:

Often, Junior Miners are not alone: Emperor Metal is sourrounded by 17 producing gold mines, and around the same number of gold exploration projects. While this is not a proof that their project also hosts gold, it is another important hint to reduce risks. (c) Emperor Metals

Once you've selected a promising junior mining company, you can purchase shares through a stockbroker. But you need to know at which stage your explorer is, and what milestones it wants to achieve. In the end, it all comes down to buying and selling at the right time. For those willing to engage with this process, these investments can prove rewarding, offering a unique opportunity to capitalize on the enduring value of gold. Have a look below at what is possible if you get it right with Junior Miners:

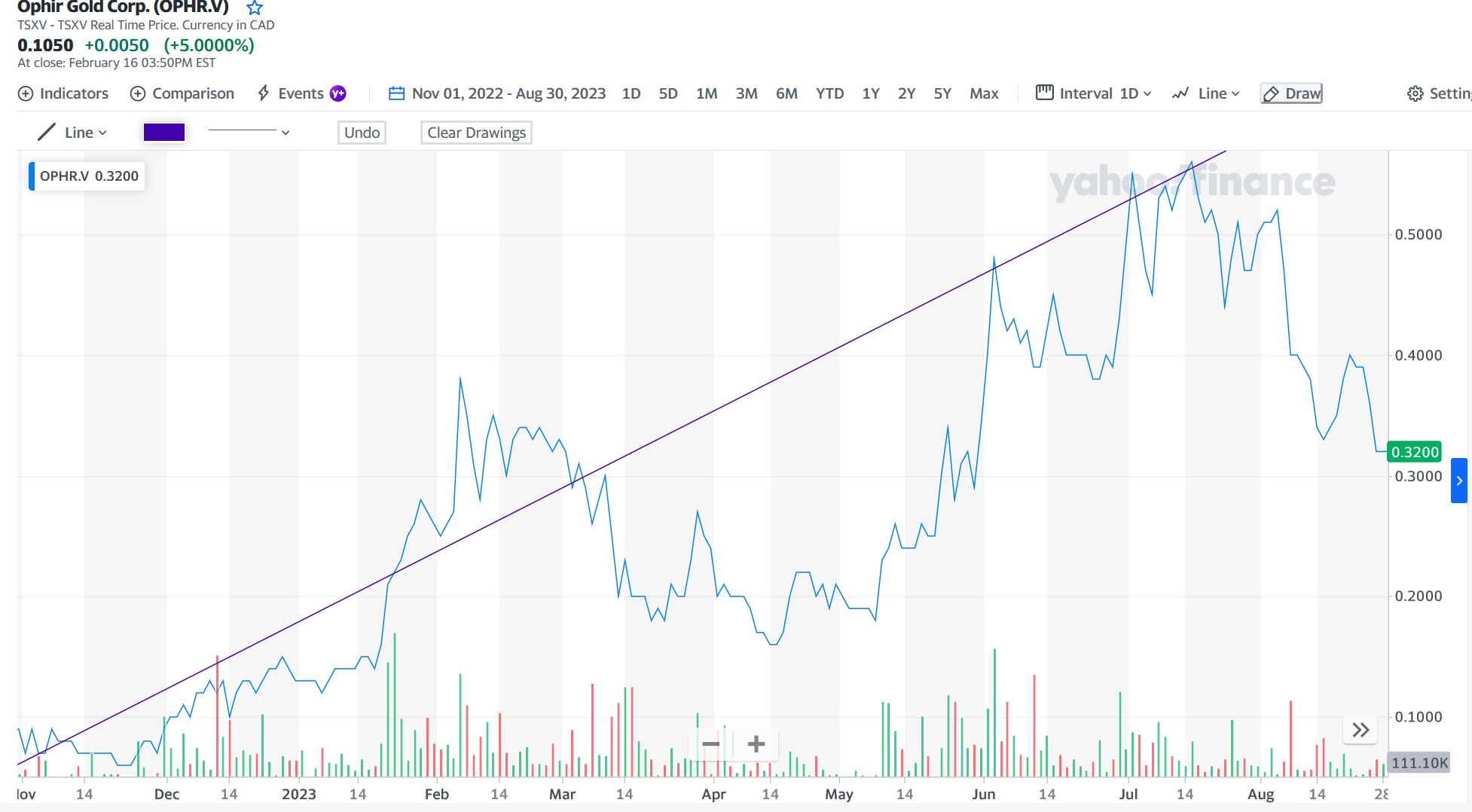

From 9 cents to 56 cents in 9 months: Ophir Gold is far from building a mine, but it was able to show to investors that it identified the right haystack, where there might be a potential needle. This could already be enough to increase your invstments by more than 500%

Two things I want to point out: Yes, Junior Mining investing is also risky. There are many companies out there, and you need to understand basic concepts of this industry, as otherwise this would be casino, not investing. However, with the understanding of how these companies work, what development stages a project goes through, what milestones need to be achieved, and adding some understanding of how to analyse a project, one can reap benefits as outlined above and elsewhere on my page.

The gold price increases: Should I buy an established gold producer or a Junior Miner?

Why don't you buy both? No, seriously, this is a valid question for aspiring gold investors. What happens with a large, producing mining corporation like Newmont when the gold price raises, and what would happen to let's say Emperor Metals, which we have feautured above. An established mining company (called 'major') will most likely experience an increase in its share price. Easy mechanics: The good that it is selling gets more expensive, so the miner makes higher profits. There is also some leverage built in, that means miners share prices can increase by more than just the plus of the gold price. As a rule of thumb (but not always), the lower the miners AISC, the higher its gain from a price increase.

So far so good. But would the Junior Miner's share price also raise? This we can't say. Because as I explained above, the oscilation of Juniors share prices is dependent on its progress it makes on developing its new gold deposit. Even when the gold price is flat, or maybe somewhat decreasing, a Junior can make hundreds of percent of share price increase when it for instance runs a successful drill campaign. Or when it can raise the hope that the deposit extends even far beyond of what has originally thought to be the case. As long as gold is not totally out of favour, progress and successes in developing its project, or in acquiring financing for that project could be enough to send the value of the Junior upwards.

Besides gold, copper and lithium, uranium will be one of the hottest metals for the next years. It promises clean, efficient and cheap energy. What's not to like? Learn more about the current environment for the radiating element in the blog

The opposite of course is also true. Hence, if you aspire to profit from the unparalleled opportunities of Junior Mining, you need to have a look at the specific company, and at their project. With a few analysis tools, you could investigate if this company will most likely be able to advance its project and achieve share price increases, or not. This 'how to' is not rocket science, but follows an inherent logic.

Sign up below if you would like to learn more about the exiting opportunities in Junior Mining, how to spot them, how to analyze projects, and how to minimze risks.