Why you should consider investing in gold

- The main reason for this consideration lies in the high flexibility and variability that gold lends to investors. Whether you seek to hedge your portfolio, or to quietly build a armory of wealth, or if you want to profit from the positive mid- and longterm outlook of gold, this precious metal is unparalleled in its options it holds for investors.

We are going to provide an overview over the many capabilities this fascinating product of the earth holds, and how you can pick the ideal vehicle, depending on your investment goals.

PUBLISHED FEBRUARY 09, 2024

Part One: Is investing in gold good?

A colleague once told me a funny description about what the gold trade is in essence: Someone digs a hole to take gold out. Then this gold is taken out, refined, and transported to a bank – where it is essentially ending up in another hole. So in essence, he concluded, one could leave the gold where it is and just sell shares of that gold to people. Same effect, but you don’t need to dig holes.

Well. That story had an intriguing point: A lerge share of mines gold isn’t really 'usable' once it sees the light (even though that is not totally true, because jewellry makes up a considerable chunk of produced gold, and, in fact, a portion even goes to industrial use). But even if it were true, would people, even in theory, accept such a deal? Owning shares of gold - even though it sits underground? Leaving some metallurgical thoughts aside (e.g. the gold below the earth isnt’ of bullion quality – it needs to be separated from ores and some other ingredients like copper), my guess is: They wouldn’t. No matter if it would or wouldn’t make sense.

Because gold is not, and never has been about reason. It has always, and will always be about emotions. When owning gold, the satisfaction from being able to look at a coin, or at a bullion bar is maybe even a better feeling than knowing about its value. Owners of gold would still love their bullions even if they were to fall in value.

And this is also why gold was chosen as a reliable tresor of value. It doesn’t corrode. It always shines. It keeps this promise of a more splendid future. There is indeed some magic when you look at gold, even at small amounts. It makes people smile, and wonder, and creates this feeling of ‘want’.

Bitcoins don't have the same function as do 24k gold coins. While bitcoins tend to increase in value much faster and higher, people who own gold would probably not exchange that for bits.

This combination of promise also made it the choice for storage of value, providing a safe heaven in times of crisis. One could have decided basically for many other alternatives. Chromite or vanadium are both rarer than gold. But they look like crap. Who would want that? So, this is an important lesson when dealing with gold: It is above and beyond the rest of minerals and metals, and in a way always will be. This is not the same as saying it will always yield more than others – in the past it often has failed to do so. But it still keeps its position as eternal storage of beauty and wealth.

Unthinkable that a pharao - or most other kings for that matter - would have used another material than gold. Egyptians specifically, because they needed long-lasting beauty for the afterlifes.

So ok, it looks nice – but what do I get out of it?

Now, let us look if it also makes sense to buy and keep gold from an investment perspective. Taking your bath in gold coins might be a fun thing if you have enough of them. But buying coins in order to be able to afford more of them in the future? That might not happen as such.

This is also why I would separate the aspect of investing in gold into two categories:

Cat. 1

You want to secure your portfolio (so take note: you need to have a portfolio in this case) against all sorts of political stupidity, economic crisis, inflationary pressure etc.

This you can do with gold. Gold or gold-based instruments in this category are directly linked to the gold price, providing some stabilization mechanism (I will explain further below what I mean by that).

For this category, we will look at physical gold (bullion), gold-ETFs, as well as at futures and options.

Cat. 2

You want to use the scarcity and demand for gold to earn income. Here, you have several options, but…instruments in this category have a leverage on the price, meaning the value of the instrument is pushed higher than the gold price increase, and falls deeper in case of a price drop.

Here, we will take into consideration share-ownership of mining companies, mixed gold funds and also look at Junior Miners. Hence, we will make a separation in this article: more conservative forms of gold investing, with moderate yields, and more aggressive forms, that could potentially yield very high returns.

That brings us also to lesson no.1 in investing: You need to know what you actually want.

Fun fact: You may want more than one option – and that is also ok.

Fun fact 2: Gold is probably the only commodity that allows you this separation. I have at least never heard about someone investing in bitcoins to protect a portfolio against economic crisis. Or..do you know anyone who is hording pure cobalt metal bars under his bed?

Let’s start now with category 1.

Stability amidst Economic Unrest

The global economic landscape is in constant flux, with political and economic events triggering frequent market swings. Politics is many Western countries in the last years has also shown its potential and willingness to aggravate crises, reducing periods of stability even more. In such an unpredictable world scenario, gold has proven to be a reliable asset. World crises, be it wars, inflation or…just the fear about either of them, will send investors rushing towards gold (making its price go up, whereas other assets like stocks go down: hence the stabilization mechanism). It remains a safe haven, recognized worldwide for its proven capacity to hold onto value when other assets crumble. Pharao Amenophis I thought so – and so can you.

But even if you just want to hedge – everyone who owns gold is also interested about how it will be doing as a keeper of value over time. Hence, what value will your Krueger Rand have in the future? You will meet all sorts of ‘gold experts’ on the internet telling you that due to the immediate arrival of Marsian troopers, gold will soon be above USD 5,000 per ounce.

What is an 'ounce'?

The gold price is given in ounces (oz): One ounce, stemming from the Latin

UNZIA, which was also used in the Roman coin system, has exactly 31,103 gramms. From Italian gold trader OROVILLA, I got this interesting information:

A one-ounce gold bar measures 47 millimetres in length, 27 millimetres in width, and comes with a thickness of 1.3 millimetres.

My approach concerning the actual value and value development is more modest:

When asked what income your ounce of gold will yield in ten years, I have a good answer: Think about what you could buy today with one ounce (which is today roughly around USD 2,000): A tailor-made suit, for instance, maybe even with a nice pair of leather shoes included.

That, my dear reader, you will also be able to buy with your ounce of gold in ten years. So, my main argument for looking at gold as a means of stability is really this stable purchasing power. Owning physical gold is not so much about speculating for a price increase. That might sometimes work too, especially ahead of a crisis – but most people hord physical gold for its stability aspects. Of course, and this is what I will be describing in the second part of this blog, buying physical gold or gold ETFs on a regular basis can also help to amass considerable - and stable - wealth.

Speculating on gold price increases through buying physical gold however is something that is not very common. What I mean is the intention to really send your portfolio skywards due to a sudden increase in the value of gold. As I said, it could work when a major crisis is unfolding, and asset owners flee to gold. But, in my view, when you speculate on something, there are better ways to do that. Because even in such cases of a correctly anticipated crisis (in which secret service are you working, eh?), gold may raise some 10, 20, 25%, but that’s mostly it.

I am not saying that 25% are bad, and that you shouldn’t do it, but it doesn’t seem the right way of using physical gold. It is a bit similar to pushing a 35 year old Jaguar XJS V12 Convertible hard on the autobahn. This car still does its 250km/h, but….its just doesn’t feel right.

Gentlemen - please treat with respect

Why the hedging with gold process works

So we can note that yes, gold will remain stable in price, and probably also could see occasional upswings. That makes it attractive to bolster your portfolio with the help of gold. Because if a crisis should occur, be it another global recession or localized economic upheaval, it will invariably wreak havoc on most investment portfolios. However, gold tends to retain, and in such times often increase its value during these troubling periods. The reason? It's a tangible asset, not impeded by changing economic trends and can't be diluted or devalued. Gold is not reliant on a company's performance or subject to government regulation, making it resilient in times of financial turbulence. Also, it can't be created at will. You will need to search for it (which costs money and time), and then you will have to mine it (which costs more money and more time). In times of crisis, asset owners want exactly these non-inflationary aspects of gold, buy more of it and hence drive prices up.

Few assets offer so many options for investors, no matter what your goals are. Download our free cheat-sheet that gives you an overview over 8 different ways to invest in gold and what they mean for you.

So, the hedging function of gold makes absolute sense. Many financial experts suggest a round-about 10% share of your portfolio that should be in investment-level gold, also called ‘bullion’:

Bullion

Gold bullion refers to investment-grade gold, commonly in the form of bars, or coins. Investment-grade gold is always at least 99.5% pure, but often you will aslo find 99.99% pureness.

Both levels correspond to 24 karat, however. The next lowest karat denominator is 18k gold, which means 75% purity. But in order to use gold for investment purposes, you will always need to trade with 24 karat.

The mid- to long term outlook for gold is very positive

But there's another reason why gold stands firm as a remarkable investment choice, and that is the increasing supply/demand gap. With gold in increasing demand – not only caused by its ability to hedge, but also to supply a growing global upper-middle class with jewelry and category 2 investments (more about that in part 2), we have reasons to believe that supply won’t be able to follow.

Are you familiar with peak oil? That is the theory that humanity has reached a point where the (economically) exploitable and geologically given reserves of oil have reached their peak, and that the overall quantity that can be extracted is getting increasingly lower from this point onwards, sending the world into a permanent status of undersupply. As far as peak oil is concerned, the exact ‘peak point’ however seems to move from one year to the next. It might come sometime, but not in 2024, and probably also not in 2025.

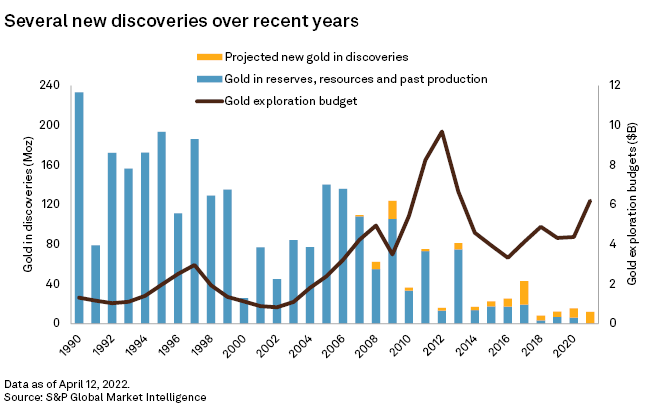

The case is different with gold though. Indeed, I am arguing that we have reached ‘peak gold’, and that we will be finding fewer deposits, and, what's more alarming, is that these come with an increasingly diminutive gold content. This is at least what a careful look at the data concerning new deposits, quantity of these deposits, and overall gold mined out of these deposits is showing: Gold is getting less, and cheap gold is getting even lesser!

"

What is adding to this story is the fact that this is happening DESPITE the fact that the budget to explore for new gold deposits is steadily increasing: In short, it gets more and more expensive to find and mine less and less gold.

Fewer deposits, less gold - higher exploration costs. Quite something.

During the 1990s, there were 1.1 billion ounces of gold found in 124 large deposits.

But since the turn of the century, only 605 million ounces were discovered in just 93 large deposits. And many of these discoveries involve lower-grade ores.

While that might be a reason to panic if your are intending to marry into an Indian family, where gold is in high course for weddings, it is good news if you are an investor. If you still want to marry in India, go ahead, but maybe you can combine that with ALSO being or becoming an investor.

Because surely, the story we have developed above is certain to put an upward pressure on gold prices in the future, boosting your gold investments.

A very short conclusion:

Gold is a finite resource: The World Gold Council estimates that there are about 190,000 metric tons of gold above the ground, with only 54,000 metric tons left to be mined.

END OF PART 1

In part two of this gold blog series, we will be talking about how you can take advantage of the unique properties that gold offers to investors