Things that can re-assure you about the potential of the project

When we don't have a lot of verified data, we need other indicators that our project has a chance of become a great hit. This blog is going to present four indicators that I like a lot in earyl exploration projects - or that are even mandatory.

PUBLISHED JULY 2024

The upside potential of early exploration -- and its risks

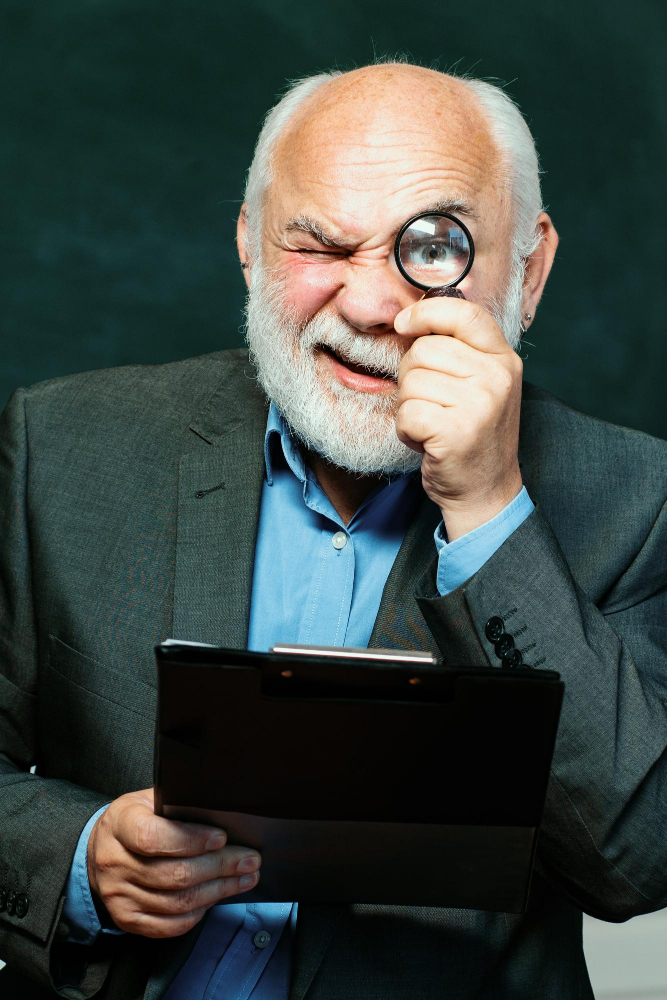

I make no secret out of the fact that in the Junior Mining space, I have a weakness for (early) exploration projects. These are projects that are really just starting with their development. One definition is that they haven’t pulled together an underlying technical-economic concept, such as a scoping study or a preliminary economic assessment (PEA). Such studies are a major milestone as independent scientists and experts put together the facts that the company has developed so far and outline what a future mine could look like, how expensive it will be to build, how much it can produce, and at what costs.

A typical announcement of a Preliminary Economic Assessment. The example is from Omai Gold. Take note of some of the key information given. Although the first of a series of studies, a PEA does provide some better clues to what the project might bring up once in production. (c) Omai Gold

This is important because from then on, we have data supporting the concept of management (or, to be true, such studies might also do the opposite and outline that the visions of management are just that – visions). In any case, once we have such studies, we start to leave the speculative territory and move over to the lands of data. Wonderful.

But…as I said, in order to put together such a study, you need to have a lot of data, most importantly derived from drilling. And this normally involves quite a bit of drilling, several thousand meters at least. So, it might happen be after the second or third drill campaign only, lets say in the second or third year only. And such studies cost money, which the Junior Miner must raise first.

But how then could I say that I like companies or projects that do not yet have such studies (I, by the way, also like projects that DO have such studies)? Do I want to argue that speculating blind-folded is, well, cool? Not really. First, the point is that, on average, early projects do have very low market capitalization. We normally talk below USD/CAD 10mio here. That on the other hand means that the upside potential is very high. This is on the pro side.

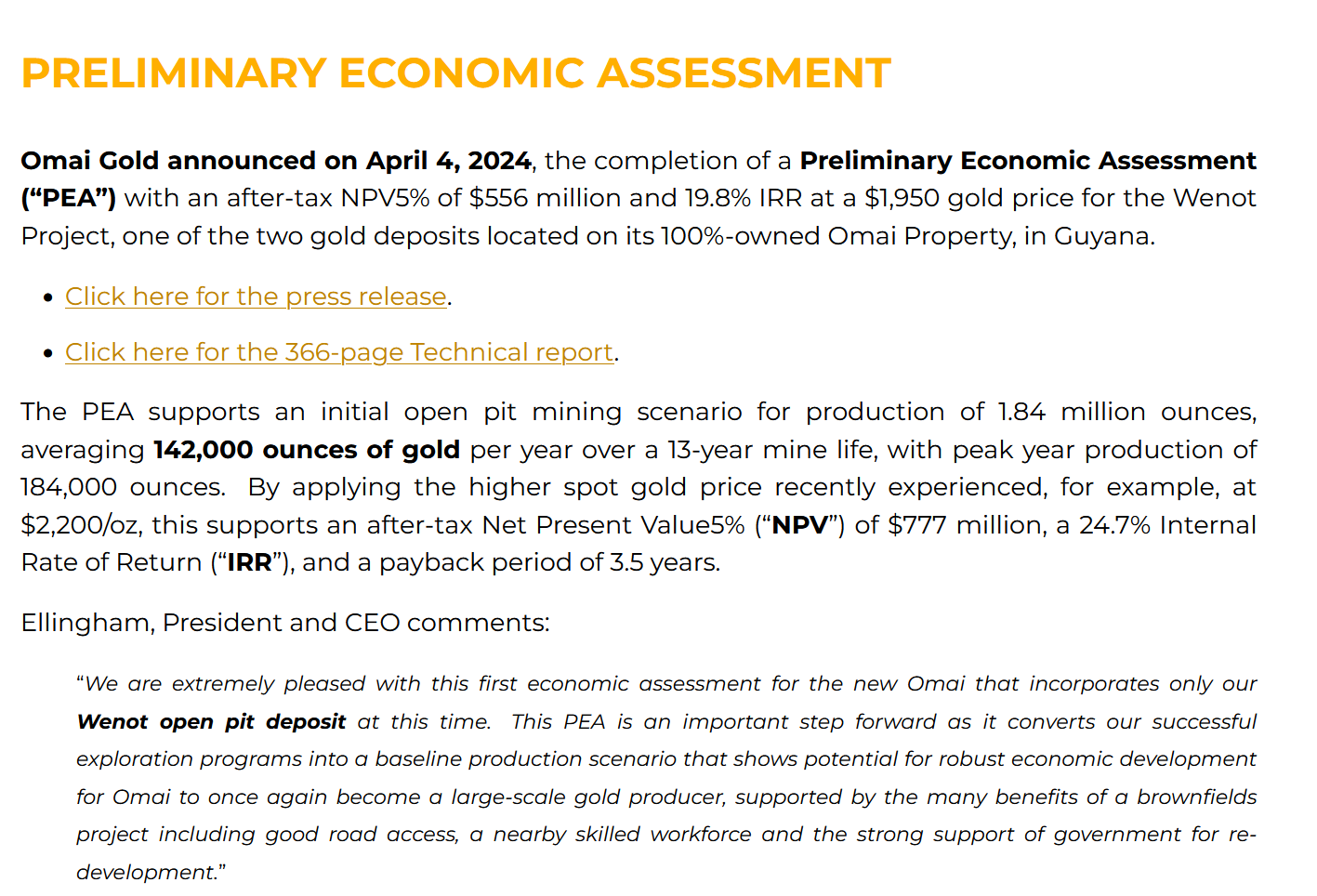

This chart of lithium explorer and developer Patriot Battery Metals is agood example of how much you can earn in return if you start early enough. (c) Onvista

The con side is that we have, as I explained above, little data available. In a way such projects are in the speculative realm. That is on the con side.

So what to do? Because I don’t want to propagate ‘lottery tickets’, or worse, Russian Roulette. I want for myself a somewhat realistic chance of success, and, more importantly, I want to be able to explain, based on reason, why I picked a project for myself. So it is obvious that we need to rely on some information and other factors. Because I don’t like pure, fate-based speculation, but I very much like what I call informed speculation.

And that is a big difference, because informed just points to what I want, and what I need – information. Even at an early stage. If it is not drill data, what else can there be?

I want to highlight four areas that I normally look for in an early exploration project in order to avoid sleepwalking through the Arctic. I don’t mention ‘top-level management’, which is kind of obvious.

Historic assays

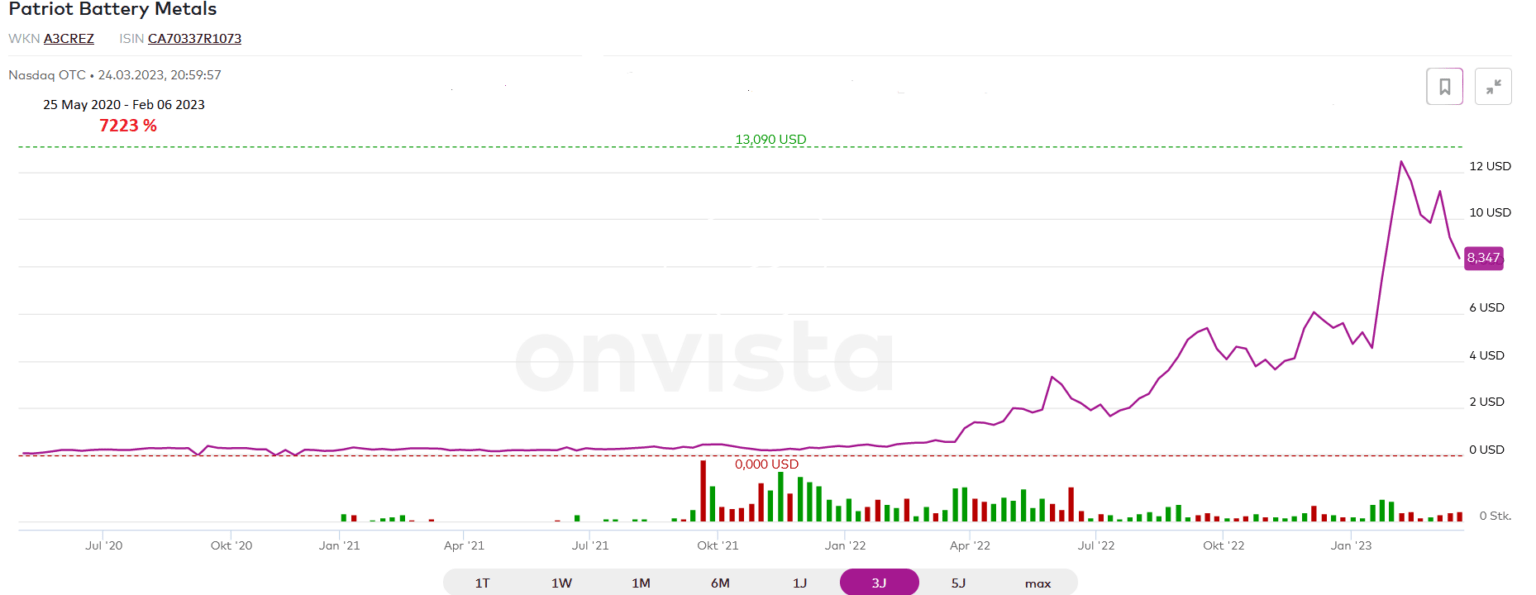

That is something that can calm investors a lot. Because it actually shows that this particular project is working in an area where others have worked before. One of the companies I have in my current portfolio for instance, Heritage Mining, works on a rather large area, where there have been numerous surface tests and even drilling over the last 90 (!) years (maybe this is why they named themselves ‘Heritage’ after all).

The row on the right from a presentation by gold explorer Heritage Mining makes reference to historic drill- and other types of field work. (c) Heritage Mining

The ’historical highlights’ are presented quite prominent. Of course, this doesn’t guarantee a deposit. But it is some sort of confirmation that the territory at least has some potential. At an early stage, we need hints, because we have little else. Another explorer that I have invested in (Emperor Metals) even brings a whole historic resource to the table. So in that case the probability that there is ‘nothing’ is zero.

Now, you might ask, if smart people have worked in territory x in let’s say 1990, why did they stop? Might it not be because the project sucked? Well, could be. On the other hand, mineral prices change. Technology changes, and that includes exploration- as well as mining technology. Infrastructure might have changed. All that combined could totally alter the economics of a project. In other words, even if a gold project wasn’t seen as economical in let’s say 1985, it may be a totally different picture today.

In any case, at least for me, having some indication of mineralization from previous times is a very good thing to have.

Where are they?

And that brings me over to the next point, which is location. I like my early explorers to not be alone out there. Sure, here and there new districts get opened up by some brave and lucky entity. The true adventurers that go all the way by themselves. Congratulations if you pick this one, but it wouldn’t be for me. One of my first investments that I did in 2016 was a Canadian gold Junior operating in a new district in Mongolia. This one actually succeeded in opening up a new district (now known as Bayan Khundii), but I only entered after successful drilling.

Otherwise, it is reassuring to know when you have neighbours. Either as operating mines or as fellow explorers. If the latter, I’d like to have some results of their work (drilling at least). Again, this is no guarantee for our project, but yet another hint.

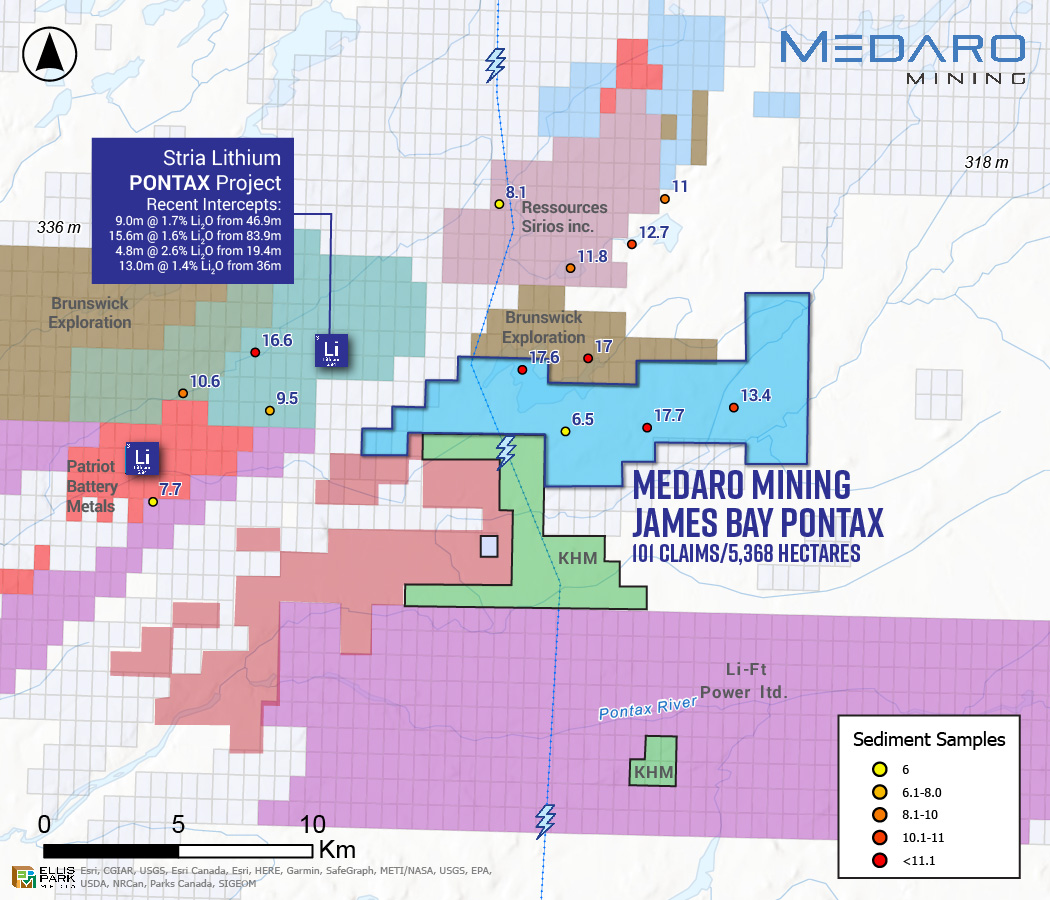

(c) Medaro

This example from Lithium Explorer Medaro shows the situation of ‘not being alone’: Their project in blue is surrounded by Brunswick to the north (brown), and KHM to the South (green). Also to note is the red territory, operated by Patriot Battery Metals. This has been the biggest hard rock lithium discovery in North America. So adjoining to them is a plus. Also note that specific reference is made to the drill results of Stira Lithium to their left.

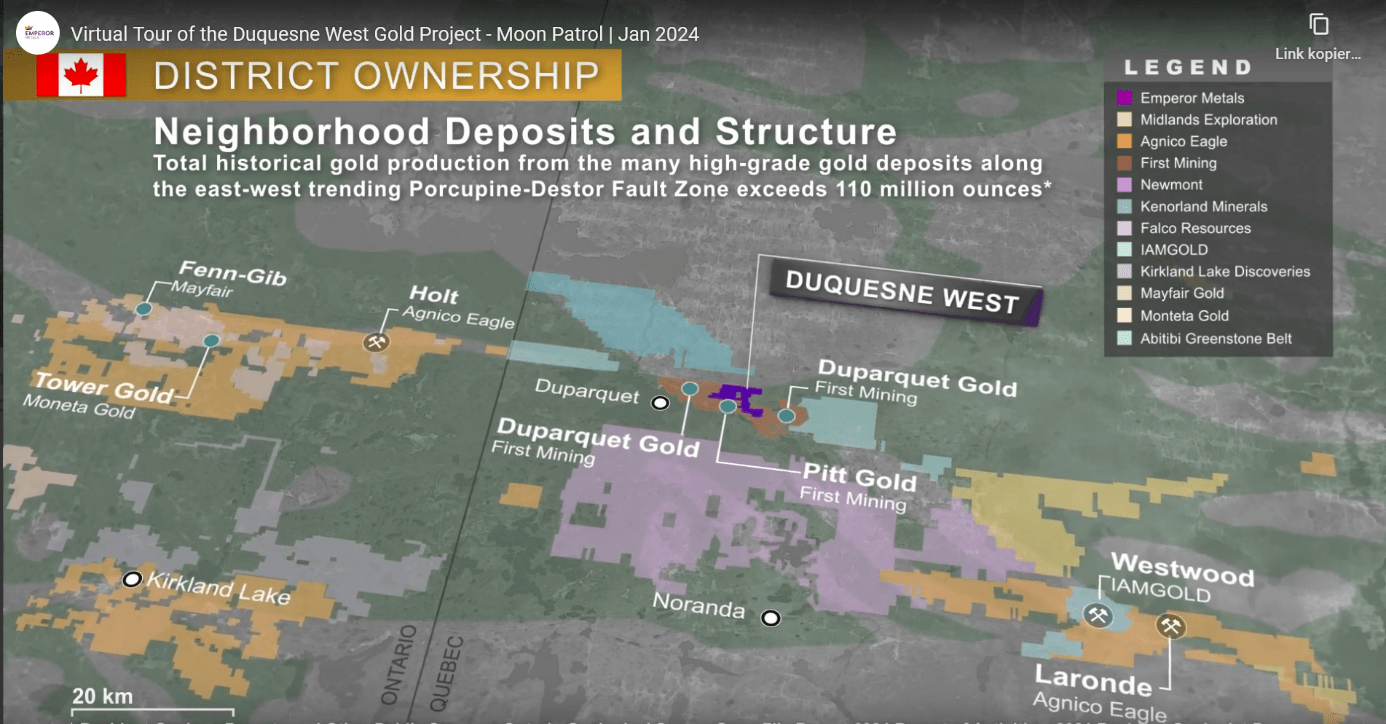

Emperor Metal's Duquesne project and its location in relation to neighbouring projects (c) Emperor Metals

This excerpt from a presentation by gold explorer Dryden Gold Corp also makes clear reference that it is not opearting in a lone desert. (c) Dryden Gold Corp

Sometimes, you might read further specifications when companies discuss their area, such that their project is ‘located on the same trend’ as the XYZ project next door (that may be producing or exploring). For gold and some other metals, that might be another advantage, as gold-bearing structures indeed could extend along the same trend, but as usual, it doesn’t put gold into the neighbouring project automatically. More information would be needed, but that is not always easy to come by.

Besides possible geological advantages, working in one area together with others comes with additional perks: Infrastructure probably exists already, and if not, their establishment could be shared with other producers. While this has advantages already during the exploration and development process, it will really keep capital expenditures down in case a mine should be built. This will make a project considerably more attractive for institutional investors at a later stage than if everything would need to be built from scratch in the middle of the Sahara in Niger for instance. It could even be the case, as with Empire above, that they don’t need to build things such as processing facilities at all, but rather can feed existing mills.

Have a look at my portfolio where I analyse a few Junior Mining companies. Get an in-depth undrstanding of what to look for and how to pull the relevant information together.

Strategic connection with a Major

While the two points above were factors to somewhat reduce geological risks, the following ones make use of the mining sector related wisdom of others.

Do you know this feeling? Making and sticking to a decision all by yourself can be intimidating at times, so when you can share this burden with others, it takes weight of your shoulders.

If for instance a major producer (we just call it major for convenience) finds interest in the same project as you do – is there a bigger proof that your decision is the right one? While this is for me personally rather a ‘nice to have’ (while the previous two points that we have discussed are normally really a ‘must have’), it is, I admit, a really nice ‘nice to have’. And this is not only for the reason that the major has the same enlightenment and wisdom as I do – but rather, their financial prowess and marketing channels could support an exploration project substantially.

It is like partnering with Apple or Microsoft when you have just set-up your own software development company.

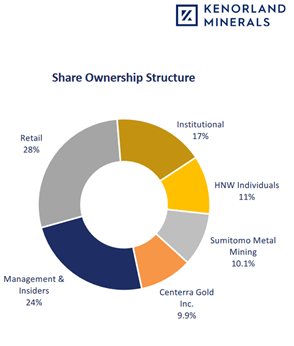

Ownership structure of Junior Miner Kenorland Minerals (c) Kenorland

Kenorland even boasts two mining majors as shareholders and strategic partners. Centerra Gold is a Canadian major with a market share of almost 2 billion CAD. Sumitomo is even bigger, and part of the Sumitomo Group, a Japanese diversified trading house. Having almost 20% ownership by majors is quite significant, and, in my view, a big plus for this Junior Miner.

It is to note that in the case of Kenorland and the tow majors, the relationship is such that there are a number of projects which Kenorland is developing and which it has ‘optioned out’ to either Centerra or Sumimoto. That means the explorer will do what they can do best (i.e. exploring and developing a project), while it is being supported in this work by the major. After a certain degree of resources have been developed (probably after a preliminary feasibility study will have been undertaken), the major has the option to take over the project. Of course against a fee. This arrangements is good for all sides involved:

The Junior, who has a better capital structure and more secure funding as well as access to financial markets. This is reducing risks for the explorer and its shareholders.

The major, who gets a pipeline of new projects developed to which he has a more intimate understanding due to the close collaboration with the Junior.

Celebrity investing

Ok, here I am not referring to a Junior Miner having to go to Taylor Swift or a Royal Family and ask for funding (even though, Family Offices and High-net worth individuals, short HNWI have become an increasingly important source for funding – see the Kenorland graph, with these HNWIs owning 11% of the company). I am referring to ‘mining celebrities’. Yes, there are, and when you have spent some years in this industry, you might even put up a poster of one of them in your office – instead of the old hockey-star poster from childhood days.

Eric Sprott, Rob McEwen, Frank Giustra and a few others are part of this group. These are distinct investor personalities who became famous for a world-class discovery, or for farsighted investments or for setting up their own Junior Mining investment funds, or all of the above.

Feel free to learn more about them when you have time, and indeed it is quite enlightening to do so, as their success stories are truly inspiring. For this text here, suffice to say that it is a kind of ‘call to knighthood’ if one of these is investing into a Junior. Often you see ownership of 5% to 10%. It is not so much the money which makes such a partnership beneficial. It is rather as I pointed out above: If these people, who have a much better understanding about the Junior Mining market than I do, and who can read projects to the detail, decide to invest – who am I to say I won’t? Ok, to be sure, you don’t have to automatically invest in a company just because a big name does. You don’t know their motivation and their terms. It is important that you pick a project because you like it. But if you do like a project and consider an investment seriously, knowing that you are an investment partner of lets say Rob McEwen is, as with the other three factors that we have discussed, just another parameter of re-assurance.

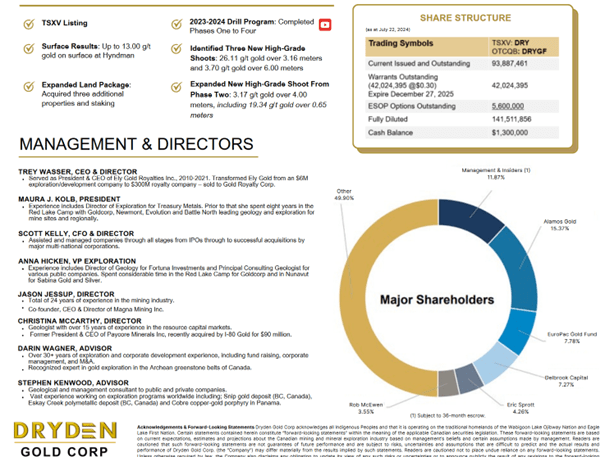

Dryden Gold Corp, which is active in the Abitibi Greenstone belt, features both Rob McEwen and Eric Sprott as investors, with both owning around 8% of the company (left graph). The former also hold roughly 10% of Emperor Metals (right graph).

Of course, other factors such as geology (or what is known of it), management, finances (debt, no debt, how much cash) etc. are important when selecting or not selecting a project. In this article I wanted to point out to the four parameters that I would like to have in a project. Do all four of them need to apply? As usual with Junior Mining investing, it is difficult to give a singular answer. If you are really convinced of a project, because you like the historic drill data or the management or the area where it works, or all of that, but no prominent figure has invested, then of course you can go ahead.

The factors I mentioned are reassuring, but gut feeling is also a strong asset in this sector.

https://shorturl.fm/VmU7O

https://shorturl.fm/r9Ew4

https://shorturl.fm/k291H

https://shorturl.fm/JlODy

https://shorturl.fm/Ffa3e

https://shorturl.fm/XzQM4

https://shorturl.fm/OGsT2

https://shorturl.fm/Oi67f

https://shorturl.fm/yGicU

Start earning passive income—become our affiliate partner! https://shorturl.fm/AS1HG

https://shorturl.fm/IPXDm

Very good https://is.gd/N1ikS2