...and how to make the best out of the upcoming uranium and copper super-cycles

Super-cycles emerge regularly in metal markets and they are the perfect time to not just invest in miners that extract the respective metal which is subject to the super-cycle, but go for Junior Miners which blossom in such periods. I will talk about that in this blog and outline that going for Juniors in metals that experience a boom provides investors with the opportunity to gain ten, twenty and more times than is the case with a regular miner.

PUBLISHED MAY 05, 2024

Boom, bust and super-cycles

As someone who is investing in Junior Miners himself, and as someone who makes a living out of transmitting relevant information and skills to smart people like you in order to invest successfully in that space, I am used to wait for these special times.

These times, when metal market signals increase in density, and when then these signals are getting supported by real data. By data that show something is going on which could mould into a situation called a ‘super-cycle.

A super-cycle is essentially a period where high demand for one or more specific metal is met by an mounting supply problem, resulting in both increased investment activities and raising prices.

In the world of metals, the supply problem is often caused by events and behaviours that date back many years before a super-cycle evolves: Oversupply, falling prices, and the near-destruction of exploration activities. Because of that, the mechanisms that apply in other markets to reduce supply and thus prices are frequently totally exaggerated in the metals space – which in turn leads to the counterreaction of super-cycles in the future. Let me explain by using uranium as an example:

The case of uranium

Popular both with army generals and utilities consumers (and of course with the medical industry), uranium is, next to fossil-based fuels, the leading provider of cheap and reliable energy. And, it doesn’t emit CO2. But it scared (some) people, specifically those that didn’t have a clue about chemical elements and engineering. When the nuclear power plant in Fukujima collapsed in the midst of an earthquake on the Japanese East Coast in 2011, it was quickly labelled a ‘nuclear catastrophe’ (even though it wasn’t), ‘underlining the danger of nuclear energy’. In a number of countries (Germany, Japan and Switzerland) the use of nuclear energy was banned (even though the latter two have since reversed their decision).

Also the History Channell labelled the Fukujima incident as 'nuclear accident', while it was really a natural catastrophy, where the plant was but one more victim. The media-framing helped to worsen the public perception of nuclear power generation.

Prices collapsed as a consequence, although of course, the story was a bit more complicated and it has to be said that prices for the radiating metal weren’t really strong independent of Fukujima. Because since the late 1990, Kazakhstan became the biggest producer and flooeded, together with a very productive and very low-cost uranium mine in Canada the uranium market, so that one could argue Fukujima was just the last nail to the coffin.

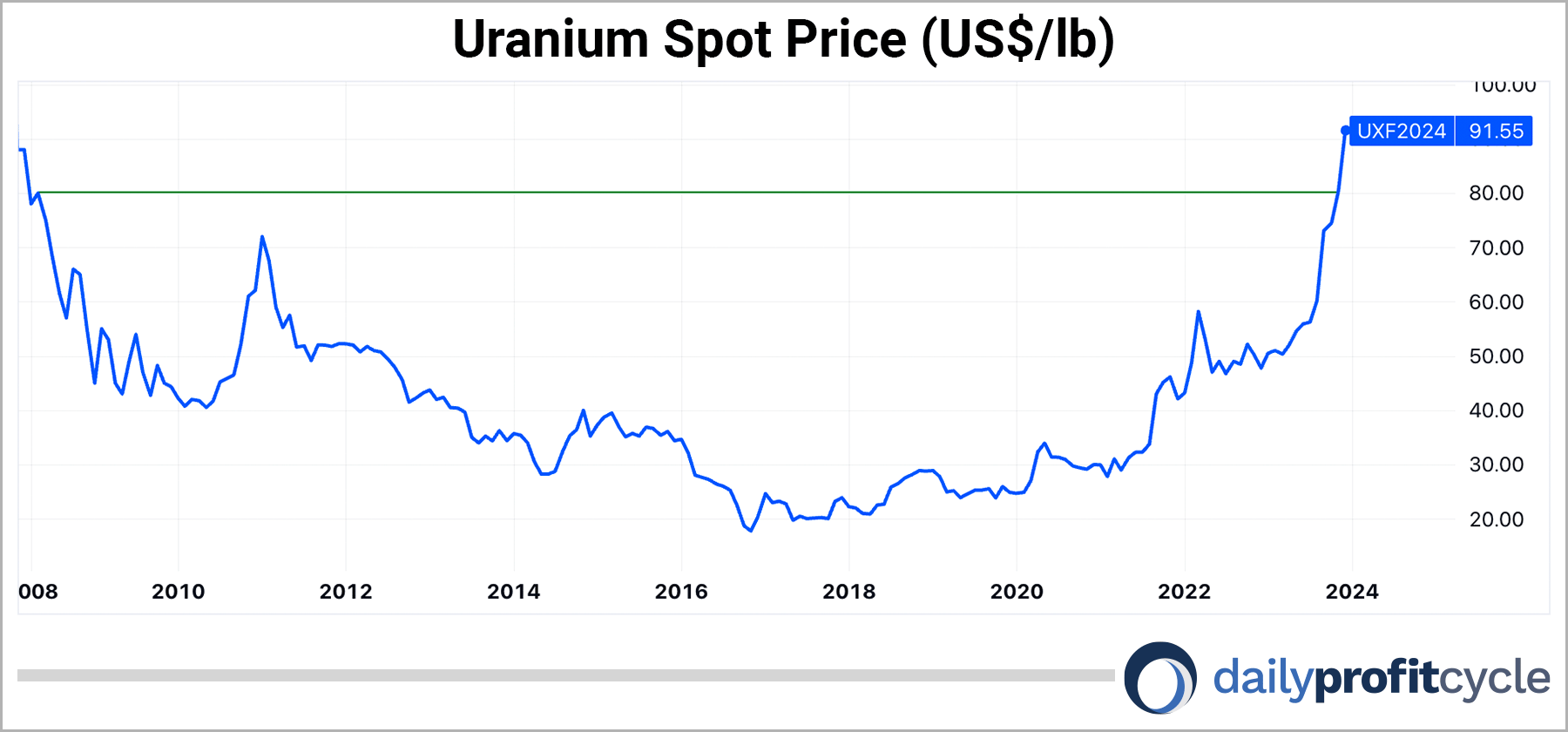

Prices of uranium fell from US $300/kilogramme in 2007 down to US $41/kilogramme in 2016, and they maintained flat for another 4 years or so. Note that by and large, the uranium miners say they need around US$ 60 in order to be profitable.

One can see a long downturn of uranium prices, only reversing slowly since a few years.

Burying the exploration industry – and killing the basis for swift revival

What I like about the mining industry, and specifically about metal markets is that there is regularly a built-in receipt for a super-cycle: Take a short version of the story that I just described above: Decreasing demand leads to oversupply as mines will produce as long as their marginal costs hit marginal revenue. That means for an individual mine it might still be good to produce, even though the price for a metal will have decreased. For all mines together that translates into this metal being produced even when markets want less of it. There isn’t a cartel like OPEC for mining (while this has been discussed on and off, I believe there are simply too many mining countries out there to reach agreement).

After a certain point though, the oversupply will have led to a decline in prices that will advance until mines couldn’t be bothered to produce any longer. They go on care and maintenance and wait for better times. So far so good, this is in principal a standard market mechanism to regulate supply and demand. But this is not yet the complete story.

Because with prices down, it is not only the producing mines that will close. No, the first victim will be the explorers. If you are currently in the process of looking for a metal that no one wants, and where markets feel there is too much of it anyway, who do you think would give you money to find more of it? Who should mine that? Exactly, no one. So explorers go out of business first, followed by the producing mines.

Mines did close, but so did exploration companies. While mines can be re-opened relatively quickly, not undertaking research for new uranium deposist for consecutive years will become a burden to the uranium industry in a few years. But it will be to the joy of investors who know about it - and invested accordingly.

So what now? Prices stay low, and nothing much happens. Really nothing. Not only will the unloved metal not be produced. There also won’t be any search for new deposits going on. So what happens if the situation reverses?

Well, if demand for a metal resumes, then there will be a problem. Take the case of uranium again. Here, we see a reversal of prices since 2018, and since 2022, they tend to be above the ‘I go out of business’ US$ 60 mark (see graph further above).

No exploration = no metals

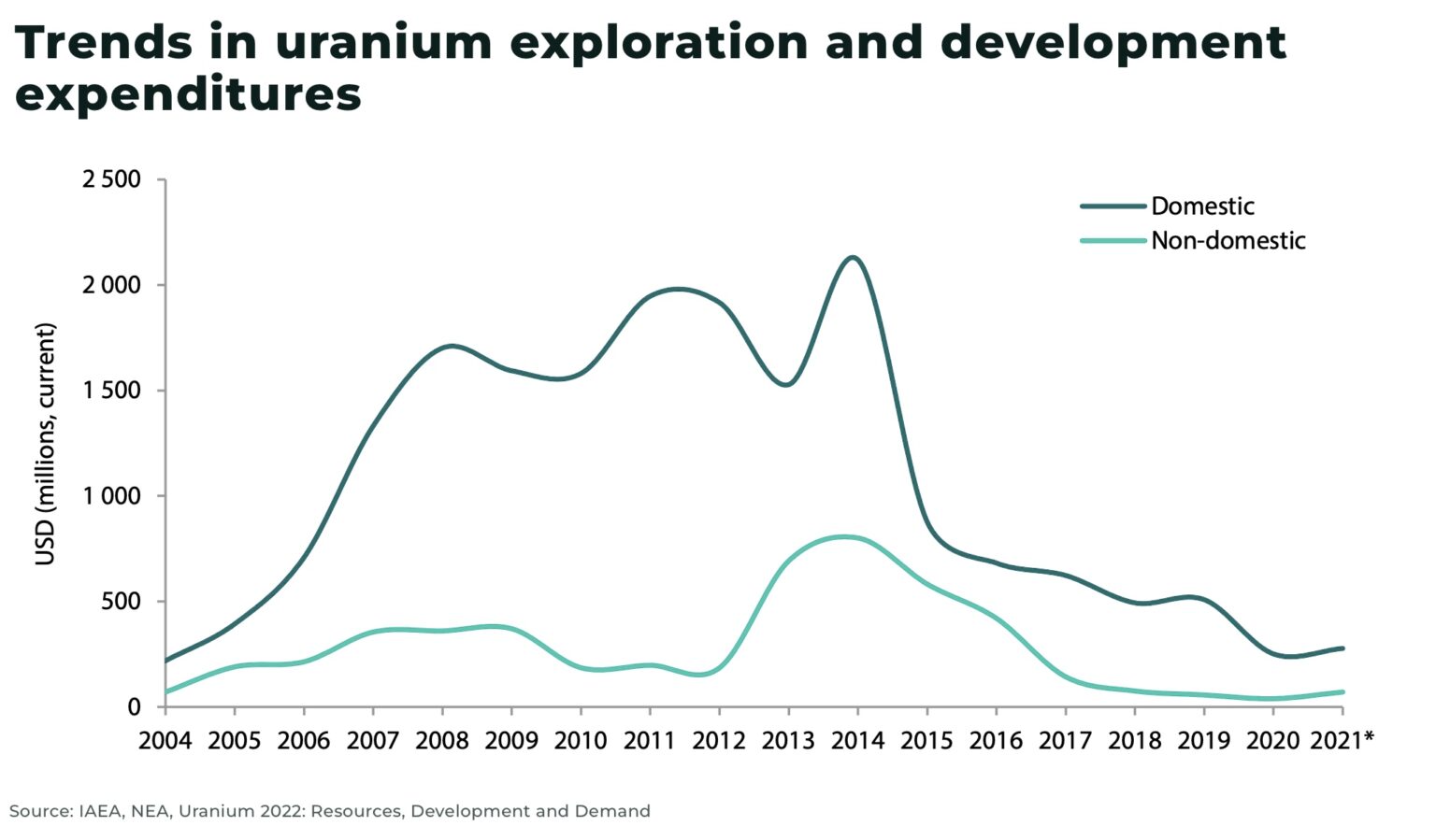

This is of course a clear-cut signal to the market to ramp-up production. The closed mines will reopen, once there is assurance that prices will stay strong enough. But in mining, supplies can not be reproduced at will. You need an underlying mineral base to do so. In other words, supplies run dry if mines get depleted. This won’t happen overnight, but remember that the last 15 years killed a lot or uranium explorers, the companies whose job it is to look for and develop new deposits. And indeed, investment in uranium exploration and mine development has fallen steadily over the last 10 years, especially after the Fukushima accident in 2011:

The consequences of years of falling prices have become very visible in the market for Junior Miners: exploration activities are quite down.

This means that for many years, the search for new projects was sharply reduced, which means there won’t be enough in the pipeline to sustain supplies. And while new explorers are now coming back online, it takes at least ten, often 15, and sometimes 20 years before an early exploration project will become a producing mine.

So while supplies are slowly decreasing, this is not taken up by new deposits coming online. There will be a gap sooner or later for which there is no simple fix. While it is at the moment too difficult to forecast when that will be the case for uranium, it is easier for copper, another major upcoming super-cycle metal. While copper had other problems in the past, there were also way too few exploration projects in the past. And those projects that came online showed smaller reserves and lower metal grades. On the other hand, copper is in strong and indeed in increasing demand, and we will likely be seeing a growing copper deficit around 2027. By that time, metal prices will experience a substantial jump.

Get a detailed view on Junior Mining - drop by my blog article where I talk about this industry in more detail:

Bullmarkets send Junior Miners skywards

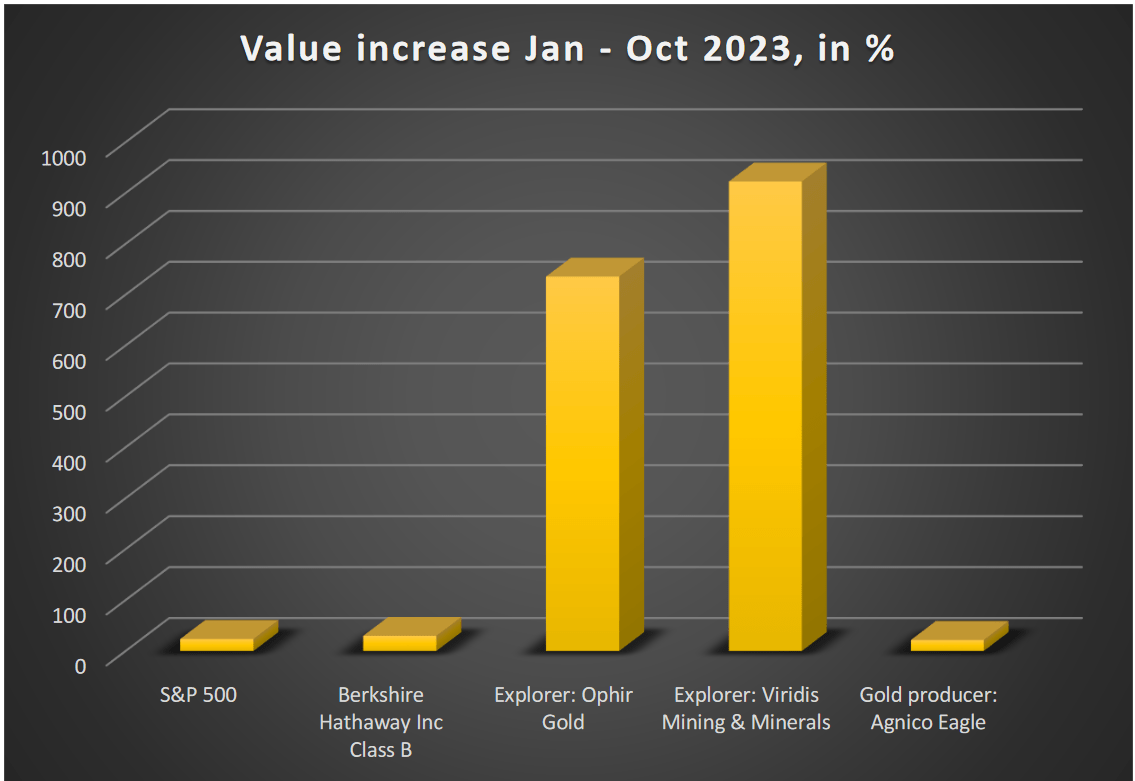

But that is not so much my main point. My main point is that such situations are pure extasy for explorers or Junior Miners operating in these metal markets. While I noted above that Junior Miners are the first to die if a metal experiences a certain period of falling prices, they are also the ones that experience a true upwards cyclone when prices start skyrocketing, and when markets feel that there will be a supply problem. Investors realize that good projects are needed to feed a world starving for uranium or copper, and because they know producers will buy almost anything, they will support project after project. And after a short while, you will see this true hype, which we could see a short while ago in lithium markets:

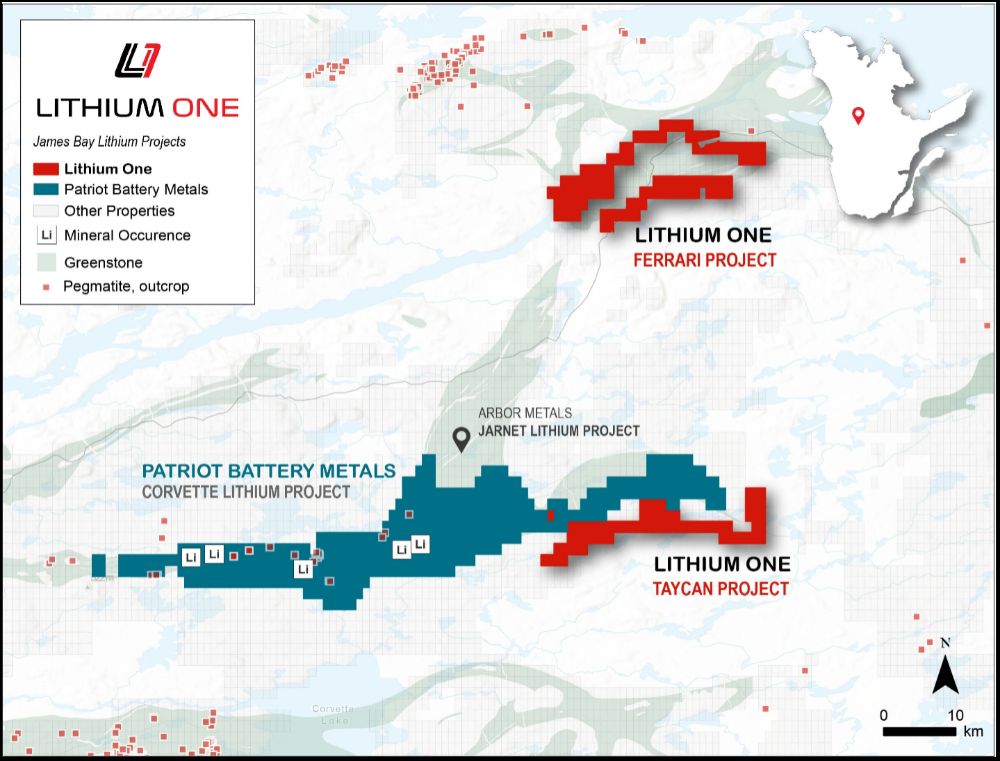

After the broad public became aware that the high-flying goals of the energy transition needed lots of lithium, and maybe more lithium than there is currently known to exist, a true lithium rush broke out. It was in the course of this lithium hype that Patriot Battery Metals, which was developing a project in Canada, rose by more than 7,000% in a bit more than two years. There were companies that gained more than 100% just by saying they are going to buy more land to look for lithium, in an area ‘that looks conducive for lithium-bearing ores’ (not a very strong statement, but apparently enough to double market value). There was another company (Lithium One) which bought a claim next to the highly successful Patriot Battery project, did some work and gained 750% between August 2022 and February 2023. Note that there wasn’t any drill campaign included. The graph below sets this into perspective:

The workings of a hype market: Just having a project near another project which performed very well could be enough to double and triple your market value.

Want to find out how to make money with Junior Miners? How to hit the big target? I invite you to read my blog article dedicated to just this topic:

Viridis and Ophir are two Junior Miners, both operating in hot markets in 2023, namely gold and lithium. They far outpaced gold producers (lright columns) or other asset classes

Uranium, the next bull-market metal:

Uranium markets will soon experience a similar hype just as was the case with lithium: The political, social and economic support for nuclear energy today is many times higher than in the last uranium supercycle! This is extremely positive.

Explorado Master Class

Want to learn everything to understand and master Junior Mining investments? Then sign up for the world's first and only masterclass, and get transformed into a true master investor.

Politicians in all parts of the world have recognized that only nuclear energy can meet the rapidly increasing demand for energy around the globe under the current climate-policy driven framework. Because without nuclear energy, climate targets cannot be achieved in the medium term. The International Energy Agency (IEA) predicts world energy consumption to increase by 18% by 2030 and by 39% by 2050, and the question is what role nuclear power will play in meeting this growing demand. Here is a hint:

All over the world, countries are building new nuclear power plants at breakneck speed:

China: plans to build 150 (!!!) new nuclear reactors, and many are already under construction

India: a bit smaller, but still 18 new plants are planned by 2035. That is two new reactors every year. By then, the country will run a total of 40.

France goes for a similar number (14), and will then produce most of its energy the nuclear way.

And so on. There is a whole uranium club, and there is wide agreement to build ‘big energy’ out of nuclear power. And that is great for investors, specifically for Junior Mining investors.

Because unlike cobalt for instance, which also experienced a boom a few years ago, but then became so expensive that scientists pushed for substitutions, uranium is sort of without alternatives – at least if you run a nuclear power plant.

And to make a hot story even hotter, I am confident that within this soon to be boiling market, there is one specific market which will be hotter than the rest. And this is the US. Because the US parliament banned Russian uranium, a major supplier so far for US plants. Hence, the States now need to look for new sources at home.

That means Junior Miners with projects in the US (maybe also Canada) will receive extra attention from investors. I will stop here because I could now go on talking projects, but I won’t. But I will do it sometime later. The story will be too interesting to ignore it.

https://shorturl.fm/RRpOy

https://shorturl.fm/uSXUI

https://shorturl.fm/gSvgv

https://shorturl.fm/sukMC

https://shorturl.fm/W3QuC

https://shorturl.fm/LWJPj

https://shorturl.fm/2UfU9

https://shorturl.fm/F8E1a

https://shorturl.fm/eAlmd